For more than 20 years, rather than fully support schools and services to strengthen their communities, Oklahoma lawmakers passed tax cuts for businesses and wealthy individuals. But now they’ve taken a different course, passing the state’s first tax increases in decades. The package, which raises more than $500 million and is paired with a long-overdue increase in teacher pay, doesn’t restore all the lost revenue from years of tax cutting. And we believe it falls short of what educators need. But it’s an important first step.

Oklahoma cut taxes sharply in the years before the Great Recession and kept cutting taxes even as revenues plummeted. It slashed personal income tax rates, sharply cut its severance (or gross production) tax on oil and gas, increased tax exemptions for retirement and military income, created a capital gains income tax deduction and abolished the estate tax on large inheritances.

All of this tax cutting squeezed Oklahoma’s “general revenue fund” dollars, otherwise known as the biggest chunk of money available for lawmakers to appropriate to schools and other state priorities.

That has made funding schools much harder. Oklahoma’s school system is the nation’s fifth-worst in providing adequate funding, according to the Education Law Center. And while most states have gradually restored the school funding they cut during the Great Recession, Oklahoma hasn’t even come close. The main form of state funding for schools is down 28 percent per student since the 2007-2008 school year, after adjusting for inflation. (The Legislature’s budget for next year, after the tax increases, includes a 19.8 percent increase in education funding.)

‘We had gone too far’ with tax cuts

The tax cuts and corresponding cuts to education funding made Oklahoma a less attractive place to live and do business. To prosper, businesses need well-educated workers, but deep education funding cuts weaken the future workforce by diminishing the quality of elementary and high schools. Funding constraints can harm teacher retention, lead to larger class sizes and limit investments in high-quality early education.

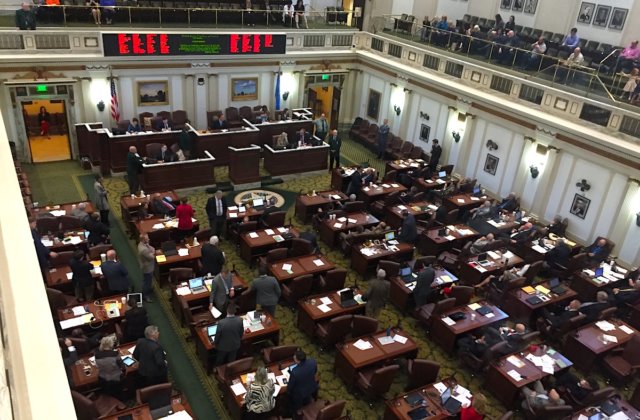

The good news is that lawmakers and the public have started to see the negative effects of draining state funds. Extreme anti-tax forces no longer have a stranglehold over the Oklahoma State Capitol, and many leading Republican lawmakers have changed their rhetoric on taxes.

“Even as a Republican, we had gone too far,” said Rep. Leslie Osborn (R-Mustang), who used her powerful perch as appropriations chairwoman last year to advocate for restoring public investments. “It was time to start investing again in Oklahoma and trying to right the ship.”

Even Gov. Mary Fallin, who supported abolishing the state’s income tax early in her tenure, has been talking about Oklahoma’s structural deficit and advocating for new revenues.

“We have two clear choices. We can continue down the road on the path of sliding backwards,” Fallin said in February. “Or we can choose a second path which is to say, ‘Enough is enough. We can do better. We deserve better. Our children deserve better, too.’”

Oklahoma lawmakers should be commended for finally starting to change course. But by themselves, their efforts this spring won’t solve the state’s education-funding problems, restore other public investments or put Oklahoma back on a path toward greater prosperity. The new revenues fall short of fully funding the commitments to raise the pay of teachers, school staff and state workers, and the state will need additional revenue just to balance this year’s budget, according to the Oklahoma Policy Institute.

At a time when schools are not the only underfunded priority — mental health and addiction services are among areas in dire need of funding infusions — lawmakers must build on the recent revenue package by pursuing other new revenues. They must focus the new dollars on targeted public investments in the building blocks of a strong economy. Repealing the ineffective and expensive capital gains tax break, as a bipartisan group of senators had already voted to do, would be a great place to start, but all options need to be on the table. The state’s future is depending on it.