(Update: On Monday, Dec. 16, Bloomberg News reported that Provident Oklahoma Education Resources sued the University of Oklahoma over the Cross Village project described below.)

According to its October 2018 meeting minutes, the University of Oklahoma Board of Regents was circumvented in the enactment of two leases for OU’s controversial Cross Village housing development. With its bonds turned to junk, the $251.7 million project now sits largely empty, spurring talk of lawsuits, alleged securities violations and ramifications for future Oklahoma bond issuances.

OU’s legal counsel, however, believes the university executed its Cross Village contracts properly and acted well within its rights by choosing this July not to renew the retail and parking garage leases included in the original agreement.

“It’s my opinion that it was properly brought before the board,” OU legal counsel Anil Gollahalli said Oct. 22. “What was brought before the board was the ground lease, and that’s the only legal obligation of the university. The only thing that the university has signed off on was in that document, and that was the 50-year ground lease and the operations agreement. So the debt is not issued by the university. It’s not the university’s legal obligation. So under our policies and protocols, it was properly brought before the board.”

Minutes from the OU Board of Regents’ Oct. 24, 2018, meeting tell a different story with regard to the $7 million parking and retail leases the university initially said it intended to renew annually:

Such recommendations to execute the Commercial Space Lease and the Parking Space License is based solely on contracted obligations previously agreed to as these agreements will result in significant financial losses to the University. While the option to lease retail spaces under the Lease of Property was mentioned in a “for information only” item to the Board [December 12, 2017 at 35893-94], the subsequent execution of that option and attendant financial obligation were not properly brought to the Board for consideration and approval before the obligation being incurred. The option to license the parking spaces was not presented to the Board.

The project’s nonprofit partner and developer, Provident Oklahoma Education Resources (POER), alleges that OU made multiple material misrepresentations during Cross Village’s creation. Provident Resources CEO Steve Hicks also says OU’s decision not to renew the parking and retail leases has left POER struggling to repay bond holders, something that could limit interest in future OU and Oklahoma bond projects.

Hicks, who has written about the situation on BondBuyer.com, said his group has partnered to create more than $4.5 billion worth of projects in 20 states.

“So we are in frequent contact with various institutional investors. It is clear that those investors are not going to look favorably on the University of Oklahoma the next time the university goes to market to sell their own bonds, general obligation bonds or revenue bonds. It doesn’t matter. They will not be looked on favorably,” Hicks said. “It doesn’t mean the state will not be able to sell the bonds, but rest assured — in my opinion — they will have to pay a much higher interest rate for their bonds because, in the eyes of institutional bond holders, they are taking a bigger risk with OU than with other universities who honor their obligations.”

‘Everybody is aware. It is a bad situation.’

The frustration Hicks mentioned from some of the United States’ largest mutual companies is palpable. On Oct. 15, a half-dozen representatives from companies like New York Life and Invesco met with legislative leaders and members of Gov. Kevin Stitt’s administration to seek assistance in negotiating a potential solution with Oklahoma’s largest public university.

“I know everybody is aware. It is a bad situation,” said House Appropriations and Budget Chairman Kevin Wallace (R-Wellston). “Whenever they asked for assistance, I wanted clarity on what they thought assistance would be. They just wanted to make sure that I would pass the message on that they would like to have the business people meet without the attorneys, and I have done that.”

At issue is the convoluted business deal struck by former OU President David Boren and former OU chief financial officer Chris Kuwitzky that built the 412-unit Cross Village student housing project. Cross Village opened in August 2018, but by June of that year only 27 percent of the apartments had been pre-leased, a far cry from the 96 percent target posted in OU’s original marketing plan.

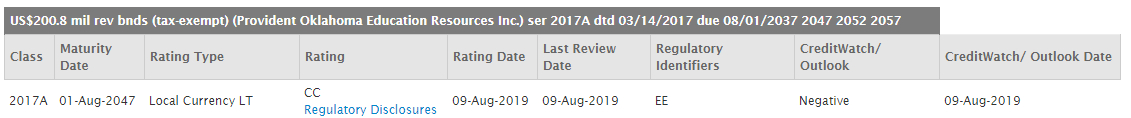

That month, Standard & Poor’s downgraded the Cross Village bonds from BBB to CC, an undesirable “junk” rating.

Hicks arranged a conference call with OU officials and 32 bond holder representatives on June 26, 2018.

“In general, the off-campus market we see today is very different than the originally anticipated market,” OU’s Kuwitzky said in the call, which Hicks provided to NonDoc. “These pre-lease targets were generated in our marketing plan (…) with an anticipated goal of 96.34 percent. Obviously we are reforecasting that at 29.86 percent now.”

Hicks told bond holders that POER and OU were working on short-term and long-term project adjustments to address and compensate for Cross Village’s low occupancy.

“We will be modifying and coming forward with a very aggressive marketing campaign to maximize the capture of remaining students,” Hicks said. “With regards to our strategic plan in the months ahead, the first thing we need to realize is OU is in the middle of transferring leadership from President Boren to a new president.”

Kuwitzky, OU’s CFO, was terminated on Jim Gallogly’s first morning as president six days later. Four months after that, he was hired as director of accounting at Washburn University in Kansas which recently promoted him to vice president for administration and treasurer.

In a September 2018 interview with the OU Daily, Gallogly appeared to reference Kuwitzky and other terminated Boren administrators as not having disclosed the $7 million parking and retail agreements to him.

“Our budgeting process is very weak, and because of that, there seems to be surprise after surprise,” Gallogly said at a September 2018 OU Board of Regents meeting.

Hicks said it took him more than six months to land a meeting with Gallogly on Jan. 16, 2019, to discuss Cross Village.

“He made it clear at that meeting that he had no intention of renewing the commercial lease or the parking license because, in his opinion, they were negotiated at much too high a rental rate or a license rate, and he was not going to do it because the university couldn’t afford it,” Hicks said.

Ultimately, Gallogly resigned in May and interim President Joe Harroz formally announced in July that OU would end the Cross Village parking and retail agreements.

“We built the project, then July 2, 2018, President Gallogly took office, and anything that had President Boren’s name on it, he attacked,” Hicks said. “And this project had been one of President Boren’s major initiatives in his last couple of years in office.”

‘The University intends to rent all of the Commercial Spaces on an annual basis’

Boren’s role in the four-building Cross Village development underscores the tumultuous end to his historic tenure as OU president. Hicks said he had met Boren as a U.S. senator but never spoke to him directly about the Cross Village project, which was financed through revenue bonds issued by the Oklahoma Development Finance Authority and underwritten by RBC Capital Markets. Hicks’ organization was brought in to form Provident Oklahoma Education Resources, a nonprofit established for the public-private partnership (P3) endeavor.

POER entered into an agreement that OU would lease parking and commercial spaces from the operators for more than $7 million per year, money POER would then use to make principal and interest payments to more than 40 mutual firms.

“They told us they would enter into a lease of the retail space on a year-to-year basis, so we structured it that way,” Hicks said.

A review of the 410-page bond issuance “official statement” from March 2017 reveals language that could ultimately be debated in front of a judge.

“The University intends to rent all of the Commercial Spaces on an annual basis,” the statement notes on page 6.

But on page 24, it states: “The University initially intends to license all parking spaces in the Parking Facilities.”

The document goes on to outline the risks agreed to by purchasers of the bonds, but Hicks said the statement’s language could be judged a “material misrepresentation” of fact, which would be a federal securities violation.

“In connection with the offering of securities of the public, you do not want to be accused of making a material misstatement to the future investments,” Hicks said. “The University of Oklahoma, through its designated representatives in March 2017, stated we have every intention of paying this lease every year and for paying for these parking spaces every year.”

Gollahalli, OU’s legal counsel under Boren, Gallogly and now Harroz, reads the document differently.

“We obviously would disagree,” Gollahalli said Oct. 22. “They clearly have made their position known. They’ve also, I believe, acknowledged that we don’t have a legal obligation under the ground lease. We think the documents are very clean. We think they are very clear as to what the obligations are.”

Harroz deferred to OU’s Sept. 10 written response to an attorney for the project’s bondholders and added, “Without a doubt it’s an important matter.”

“I came into this when i came into it,” Harroz said Oct. 22. “The university’s position is where I am. I don’t have any really unique perspective.”

Cross Village featured unusual $20 million ‘initial payment’

Among the important elements of the Cross Village project, Hicks and bondholders publicly and privately have another concern: What did OU do with a $20 million “initial payment” made by POER when the 2017 bonds were issued?

“I’d have to check with the CFO,” Gollahalli, OU’s top attorney, said Oct. 22.

Harroz said: “We can get an answer to that.”

The pair did. According to an email from Stewart Berkinshaw, OU’s Office of Budget & Financial Planning director, a majority of the initial payment remains unspent.

“A portion of the funding received was used for demolition of the old Cross complex, relocation/remodel costs for office tenants in the old Cross complex, and payment to a third-party company that assisted with the Cross project evaluation,” Berkinshaw wrote. “Because the $20 million was not annual recurring funding, it was not budgeted as part of the university’s normal operating budget. After the costs mentioned above, $12.8 million remains unspent and is a part of the university’s unrestricted cash reserves.”

Hicks referred back to his January conversation with Gallogly about the project.

“What he would not acknowledge was that another reason that the university entered into the commercial leases and parking leases was because the university was in need of cash,” Hicks said. “In a transaction like this, normally the ground lease — whenever the university leases the site to use where the project will be built — they will lease that to us on a term of 40 to 50 years and the lease payments are paid on an annual basis.

“Well, OU wanted to make sure they got all of the money up front. So instead of us paying $1 million or $1.2 million a year in payments over the life of the financing, we wrote a check to the university for about $20 million on the day of bond closing in March 2017.”

Hicks said the $20 million was additional money borrowed for the project.

“The only way you could pay that $20 million back that we had borrowed and paid to the university was they either had to increase the rent paid by the students, or they had to increase the rent they paid for the commercial space and parking spaces,” Hicks said. “That’s what the university agreed to do. So as part of their agreement to lease the commercial retail and lease the parking, they also agreed they would lease it at an increased dollar amount above what would be fair market value. That was their decision because that was the way they got their $20 million.”

Legislator: ‘To me, it was a bad deal all the way around’

After meeting with bond holder representatives, Gov. Kevin Stitt’s office and the Oklahoma Legislature’s appropriations chairmen are paying attention.

“The governor is monitoring and staying briefed on the situation, but the constitution does not give him the authority to be a decision maker on this matter. That authority is given to the OU Board of Regents to resolve as they best see fit,” said Donelle Harder, senior advisor for Stitt. “To date, he has made two appointments for a board of six. We are actively working to also fill the recent vacancy.”

Senate Appropriations and Budget Chairman Roger Thompson said his main concern was whether the state of Oklahoma has any responsibility to address the Cross Village project.

“Right now, I don’t think we do. I think this is totally an OU deal. I don’t see how the state is liable for any of it,” said Thompson (R-Okmulgee). “But as I am getting questions from my constituents and others, and of course being appropriations chairman, I certainly want to know what’s going on with one of our state institutions.”

Thompson is not alone in that desire. Kevin Wallace, the House appropriations chairman, said he believes neither OU directly nor the state of Oklahoma generally has a financial obligation to repay bond holders.

“To me, it was a bad deal all the way around, and I don’t know why they signed up for it,” Wallace said. “The only reason they did it was because they intended to make money, and significant money. But I cannot justify OU even giving in to saying we are going to continue down this path and charge students more or taxpayers more to correct this problem.”

Thompson said he was concerned by the October 2018 OU Board of Regents note that said the retail and parking leases “were not properly brought to the Board for consideration and approval.”

“I’m surprised that the administration of the school would have moved forward unilaterally without having the regents behind them,” Thompson said. “My meeting with OU is still coming up, and I want to understand their side.”

In September, an OU professor released a phone call recording in which Boren repeatedly said he could “only slip so many things past” OU regents as he was “going out the door.”

Wallace said strained relationships between OU and the 40 financial investment firms stuck holding junk bonds could mean less interest in future bond issuances if the situation is not resolved.

“You’re going to end up paying a half or a full point more,” Wallace said.

As a result, he said all parties should get together and strike a solution that ends the turmoil before lawsuits are filed.

“I believe through litigation no one wins but the attorneys, in all matters,” Wallace said. “Truly, negotiations would probably be the best way to get to a resolution. It will be like good legislation: Nobody is happy, but it’s a good deal.”

Gollahalli said OU would like to find a compromise.

“I’m hopeful that we will be able to engage in the mediation and have a productive conversation,” Gollahalli said. “If Provident or other parties have ideas, we are always happy to entertain, but we can’t be the ones driving it without further entangling ourselves beyond our current legal obligations.”

Wallace called the situation “quite a mess.”

“I think when you step back and take the 30,000-foot view and say, ‘Why did this happen?’ There are a lot of factors, and the bottom line is that people thought they were going to make a profit, whether you think that was OU with the $20 million or the bond holders,” Wallace said.