Oklahoma’s cities and towns are sure to lose sales-tax revenue because of the COVID-19 pandemic, but the scale of the impact won’t be known for some time. Depending how long the crisis lasts, however, the effects could gash municipal budgets.

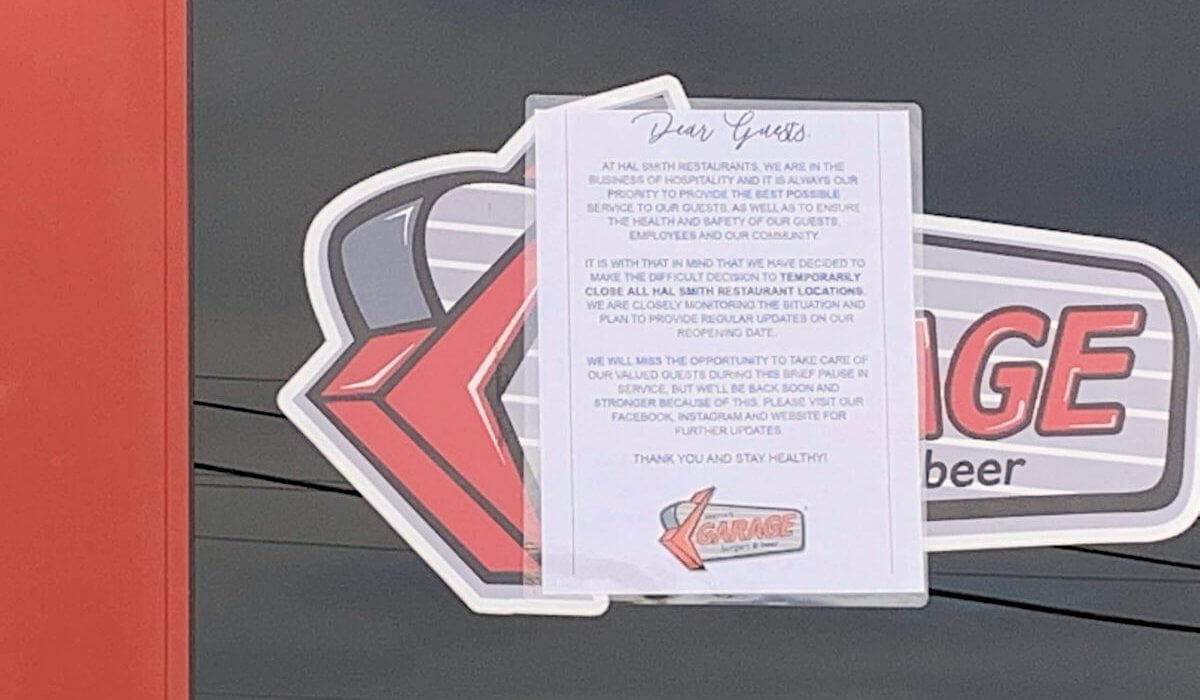

Tuesday, Gov. Kevin Stitt ordered all non-essential businesses in counties with at least one positive COVID-19 case to close for 21 days. That includes businesses such as massage parlors, hair salons, and various stores that don’t sell food or other essential goods. It follows the earlier closures of theaters, gyms and bars in the state’s largest cities. Restaurants have been forced to feature only takeout dining.

The closures mean more than just a bored citizenry. Oklahoma City gets about 54 percent of its general-fund revenue from sales-tax receipts. In this fiscal year, that number was projected to be about $254 million. City budget director Doug Dowler said the pandemic’s effect on municipal sales tax revenue won’t be known for a while.

“On April 1, we will get (revenues from) February and an estimate on the first half of March,” Dowler said. “[Business owners] will estimate the first half of March using last year’s payment as an estimate. So when we get our April check, we won’t know how bad things were in March. There’s definitely going to be a significant impact, but how big is hard to say right now.”

Sales-tax revenue from grocery sales is unlikely to fill the gap. Panic purchasing recently left many metro stores overrun with customers for days on end, but some of that has slowed.

“I think there’s certainly going to be a boost from food and general merchandise stores from people stocking up, but I’m not sure how much that will make up for the loss of restaurants,” Dowler said. “I think that will level out as people get stocked up at home.”

Small towns and mid-size cities face losses

Though Tulsa and Oklahoma City are the state’s two largest population centers, other municipalities are also facing significant revenue loss from sales taxes, which are the primary source of funding for cities and towns. In the state of Oklahoma, municipalities are prohibited from levying property taxes.

Norman, Lawton, Broken Arrow and Edmond are among a growing list of communities that have restricted businesses, including restaurants and bars, amid the pandemic. The mayor of Norman, Breea Clark, has taken perhaps the most aggressive approach, issuing a stay-at-home declaration that can be enforced by fines.

“It’s absolutely going to have an impact,” said Mike Fina, executive director of the Oklahoma Municipal League. “Sales tax is the main source of revenue for municipalities. With more cities putting restrictions on businesses, that will hurt our tax collections. But the first concern is public safety. That is at the forefront as these hard decisions are made.”

In 2019, Norman and Edmond took in about $60 million and $46 million, respectively, in sales-tax revenue. Fina said municipalities of that size might be most at risk.

“Oklahoma City has several sources of revenue, and the sheer number of businesses helps with that,” Fina said. “But smaller cities don’t have that, so it’s going to have a bigger impact on them.”

Municipal budget cuts feared as sales-tax revenue slows

When cities face a loss in revenue for an extended period of time, budget cuts often follow. That could mean reductions in parks-and-recreation programs, layoffs of city workers and cuts to police and fire departments. The $2 trillion stimulus package being considered by Congress would include money for larger cities and states facing budget dilemas.

“My hope is that it’s not something we have to deal with,” Oklahoma City Ward 2 Councilman James Cooper said of budget cuts. “We just don’t know yet how bad it’s going to be as far as sales tax, but it’s clear we need to be prepared and start thinking about what it’s going to look like.”

The OKC City Council is slated to hold its March 31 meeting under the state’s temporary new rules for teleconferencing.

Oklahoma City Firefighters Association President Scott VanHorn said the loss of sales tax revenue could have a long-term impact on pay for those in public safety.

“Every department in the state funds their department operations through sales tax,” VanHorn said. “So that could affect their negotiation process in the future.”

Van Horn said OKC is unlikely to see cuts to public safety, thanks to the Better Streets, Safer City sales tax voters approved in 2018.

“It won’t happen in OKC because our citizens have taken good care of us,” VanHorn said. “They also passed a three-fourths-cent tax in 1989. But you have seen cuts in lean times in other cities in the state, especially during the oil bust.”

VanHorn said he and others in public safety have been pushing to change Oklahoma’s reliance on sales tax to fund municipal services. Most cities in other states use some amount of property taxes to fund those same services.

“Sales tax can be volatile, and you see that during times like this,” VanHorn said. “We’ve been pushing to get away from that model because you just never know what is going to happen. It can be something like this, or a natural disaster, that can impact sales tax. The last thing we want to see is police and fire departments getting shut down because their sales-tax revenue is reduced or interrupted.”

Fina said the state lags behind others in its funding structure. Currently, Oklahoma’s public safety departments can’t use bonds to fund their operations. Those funds are usually limited to capital purchases, like 911 infrastructure, fire trucks and police cruisers.

“We have 49 other states doing it a different way,” he said. “We’re the last one that does it like this. We really need to restructure how we do things. It’s long overdue. You see how it can be impacted when things like COVID-19 happen.”

Fina said HB 1992 in the Oklahoma Legislature that would allow municipalities to use a limited amount of money from bonds to fund operational expenses. The bill passed the House in February, but it’s unclear if it will receive final approval this session. The Legislature adjourned indefinitely March 17 and is primarily focused on passing a state budget before its May 29 constitutional deadline.

Will OKC’s MAPS 4 projects be delayed?

Oklahoma City voters approved the latest, nearly $1 billion MAPS package by a wide margin in December.

The projects in that package rely on sales-tax collection for funding. While it’s possible some projects could be delayed, the city has been conservative in its estimates for funding MAPS projects throughout their history.

“The good news is with the MAPS projects being spread out over a long period we have time to recover,” Dowler said. “When we plan for MAPS, we’ve looked at seven-year periods going back to the 1980s. We take into account when we have downturns and upturns in revenue.”

Dowler said the MAPS funding model is based on 1.4 percent growth annually in sales-tax revenue.

“We definitely want to be conservative because it’s such a long period of time,” he said. “You don’t know what’s going to happen in those intervals.”

Cooper said MAPS 4 projects remain vital to the city. He said walking around his local neighborhood during the COVID-19 pandemic has made that even more clear.

“I just walked from my apartment in the Paseo, and I’m so proud to see all of the investment residents have made in that area,” Cooper said. “This was a place that was left behind for decades. And MAPS 4 ensures other urban core areas will see investment dollars which are needed. Sidewalks are still sporadic. If you don’t have a car and you’ve got to get to the grocery store in a pandemic, that’s a problem. It’s been a systemic problem for too long. So even with COVID-19, MAPS 4 remains vital.”