After making a purchase at a Grant County business this spring, Cindy Bobbitt noticed a charge she was not expecting.

“We’re farmers, and we do business and charge and get our bills monthly and pay them, and I’m one of those people who goes through my bills,” she said. “I was going through my receipts, and I noticed (the) sales tax.”

Bobbitt was surprised because a 1 percent Grant County sales tax reflected on her receipt — which voters originally passed in 2011 to help fund county law enforcement and fire department operations — had expired on April 30 and, because of a number of delays in setting an election date, had not yet been renewed.

A former Grant County Commissioner, Bobbitt questioned the business owner.

“He called the Oklahoma Tax Commission,” she recalled, “and I don’t know who he spoke to, but he said they told him, ‘Yeah, go ahead and collect it. It’s too much work to change it, and they’re going to go ahead and pass it in two months.'”

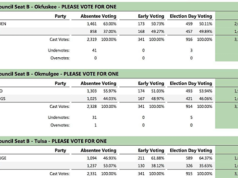

It’s true that the tax was eventually renewed July 13 — by an overwhelming margin of 616 to 43 — and will take effect Aug. 1 for another 10-year period. But for Bobbitt and others, the gap between the expiration and renewal has raised a number of serious questions.

Bobbitt, who left office in December, said she strongly supported renewing the sales tax because county public safety departments need the money, but she doesn’t understand the lack of clarity around the timing of elections and why the deadlines weren’t met in the first place.

“Someone has to be responsible that we follow the law and the rules and the regulations,” she said. “It’s unfortunate that the deadlines were missed, but if three months is OK, why not go a year or 10 years and say, ‘Oh, it’s OK, so why do we even need to vote for it?'”

‘We had some hiccups getting the election lined up’

Grant County sits along Oklahoma’s northern border with Kansas. Its largest towns include Medford, Pond Creek and Wakita, made famous for its turn as the backdrop of the 1990s film Twister. The county’s population is about 5,000, and its primary industry is agriculture.

According to agenda records of the Grant County commissioners, the three-person body took up the issue of setting an election date to renew the sales tax during its Feb. 16 meeting. The measure failed to make the April ballot because the wording of the proposition was too long and had to be re-written, missing the deadline, County Commissioner Max Hess told the Enid News and Eagle.

The election was then set for May 11, but that date was later scrapped because Grant County Clerk Cindy Pratt did not advertise the election for the required 30 days.

Pratt did could not be reached by phone at her office number and did not reply to an email from NonDoc seeking comment on the delay.

Ultimately, the county commissioners set July 13 for the special election, more than two months after the tax expired.

“I know that the people in Grant County have been really supportive of these emergency services,” Hess told the Enid newspaper on election night. “And even though we had some hiccups getting the election lined up, it sure was good to see the vote turn out like it did.”

Follow @NonDocMedia on:

Tax Commission: Rate change requires notice

Oklahoma Tax Commission spokeswoman Cassandra Sweetman said the state agency was not notified of any change in Grant County’s sales tax rate following the April 30 tax expiration, adding that the rate can only be changed on a quarterly basis.

“A change of sales tax rate can only occur on the first day of a quarter,” Sweetman said in an email to NonDoc. “It is the responsibility of municipalities and counties to notify the Oklahoma Tax Commission at least 60 days prior to an increase or decrease of a sales tax rate change (Oklahoma statute Title 68, Section 1370). As per the Agreement for Administration of the Sales Tax Of Grant County and the Oklahoma Tax Commission, the rate the Tax Commission collects must remain the same until notified of any changes. The Oklahoma Tax Commission has not received notification of a rate change from Grant County in 2021.”

Sweetman said OTC employees would not advise a business owner to continue to collect an expired sales tax.

“Without knowing more details about the relayed conversation between the merchant and the OTC employee, we can’t comment on what may have been said,” Sweetman wrote. “However, employees of the Tax Commission would not advise a business to continue to collect a tax rate for a county if the Tax Commission had been notified by the county that the rate was no longer valid within a timely notification of the change.”

Grant County sits within the district of Sen. Roland Pederson (R-Burlington). He has followed the story of the sales tax over the past few months.

“I know they’ve missed some deadlines and there was a problem because they didn’t have an election board secretary for a while, and then they appointed a new one,” he said. “You can kind of see how it happened and how maybe some things could be missed that end up causing delays, but it sounds like everything is on the right track now, which is a good thing for the county and first responders.”

Pederson, who is a rancher and retired educator, said he can understand why someone would question a sales tax charge after April 30.

“My thinking is if it expired, it expired,” he said. “I can understand why someone might wonder what’s going on.”

(Correction: This article was updated at 12:10 p.m. Wednesday, July 28, to correct reference to the community of Pond Creek. NonDoc regrets the error.)