While they wait on the state Supreme Court to make decisions regarding $800 million in OG&E ratepayer debt securitization bonds, the Oklahoma Development Finance Authority today authorized three other securitization issuances to buy debt held by Oklahoma Natural Gas, Public Service Company of Oklahoma and Summit Utilities Oklahoma, which could total a combined $2.7 billion.

ODFA would use the bond proceeds to purchase ratepayer debt held by the companies since the February 2021 winter storm, and the agency would then pay off the bonds over extended periods of time with monthly tariffs that consumers would see on their utility bills. Following today’s board authorization, the three issuances will need to receive approval from the Council on Bond Oversight on March 10 and then the Supreme Court.

Details of the three securitization projects involve:

- Oklahoma Natural Gas — $1.45 billion to be paid off over 25 years

- PSO — $725 million to be paid off over 20 years

- Summit (formerly called CenterPoint Energy) — $95 million to be paid off over 15 years

“I wish I could give you an idea of timing for when we would actually be in the market. Unfortunately, we are kind of at the discretion of the court,” said Jared Davidson, the private bond legal counsel ODFA has retained for the securitization program.

Davidson and ODFA director Mike Davis provided the ODFA board with an overview of where the OG&E bond project stands before the Supreme Court.

In the 2021 legislation creating the utility securitization program, the Supreme Court is required to conduct a general overview of each bond project. In addition, former Rep. Mike Reynolds (R-OKC) has filed legal challenges against the OG&E project specifically and the overall securitization program.

“If the court grants approval (in OG&E), we are probably looking at a 30 to 45 day timeline from the time we get an opinion, a rehearing period, and the actual printing of the bonds,” Davidson said. “We would hope that with a favorable opinion of the court we are in the market with the OG&E bonds in late May or early June.

“Hopefully (we will) have all of these transactions completed by the fall.”

Davis emphasized that without ODFA issuing bonds and buying the ratepayer debt from the companies, those companies would simply take out their own loans and still collect payments from ratepayers to pay off those loans, which could come with interest rates up to four or five times higher.

“Corporations issuing corporate debt — who knows where the market is going?” Davis said. “It makes a big difference, especially when you are talking about a 15, 20 or 25-year period.”

Reynolds named Davis and board members in his lawsuit against ODFA that challenges the constitutionality of the securitization program. Specifically, Reynolds argues that a vote of the people should be held prior to taking on such debt.

The Supreme Court has asked Attorney General John O’Connor to signal whether his office intends to intervene in the securitization matters. Davidson told the ODFA board members that such a request from the court is fairly standard, considering the unusual circumstances.

“These proceedings are not the norm at the court, and we’ve got a lot of new justices where it is their first time seeing a proceeding like this,” Davidson said. “I appreciate the fact they are being diligent and reviewing all of the materials that have been presented for them.”

Big developments in Goldsby

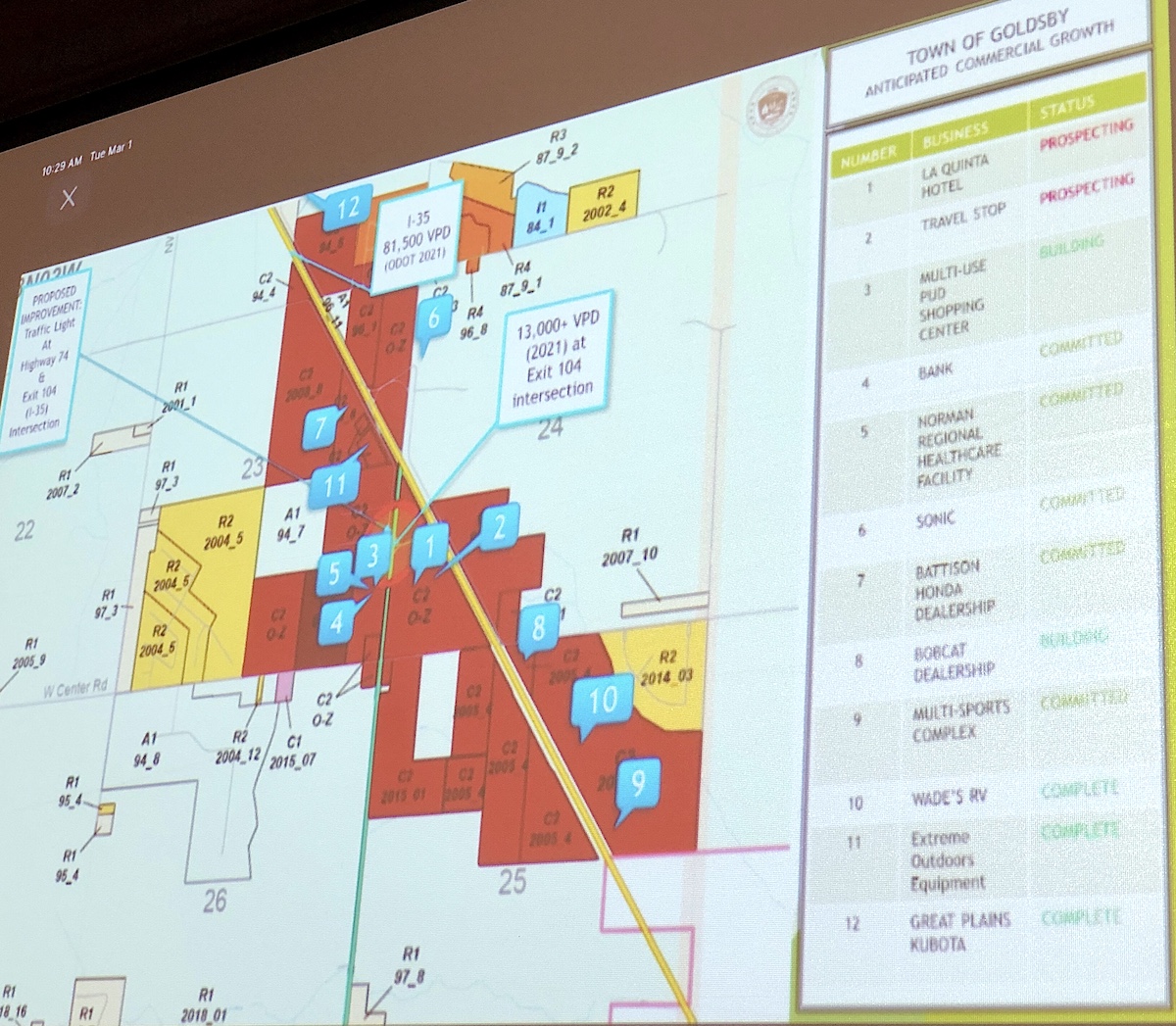

The ODFA also approved a $1.2 million Oklahoma Community Economic Development Pooled Finance Act award to the town of Goldsby to assist with a $5 million water utility project.

Adam Vossen, town administrator of Goldsby, told board members that the 2,700-person community south of Norman along I-35 is expecting significant residential and commercial growth in coming years, with a hotel, restaurants, a health care facility and a multi-sports complex partially owned by MLB outfielder Lorenzo Cain all potentially on the horizon.

Goldsby currently draws its water from seven wells along the South Canadian River and purchases additional water from Newcastle, which purchases water from the City of Oklahoma City.

Vossen said another 1,500 to 1,800 homes are scheduled to be built just west of Goldsby’s city limits in McClain County.

State has ‘mega-projects’ in pipeline

Davis concluded Tuesday’s meeting by speaking generally about Oklahoma’s economic development and potential private investments in the state.

“I’ve been in this seat a long time, and I cannot remember a time with so many mega-projects lined up. It’s exciting, but workforce is a major issue,” Davis said. “When I say mega-projects, the smallest of these needs 500 employees. Up to 1,500 or 2,500 employees. A lot of serious consideration being given to the state of Oklahoma.”

He referenced the conflict in Ukraine and urged his board members to fill up their gas tanks on the way home as oil has climbed above $100 per barrel.

“The geo-political issues that are happening overseas are just going to hasten the on-shoring of manufacturing,” Davis said. “I think there are tremendous opportunities for our state.”

(Editor’s note: Public Service Company of Oklahoma has made a charitable sponsorship to the Sustainable Journalism Foundation since 2020.)