(Update: SB 1103 did not receive a Senate floor hearing before the March 23 deadline, although the topic could be negotiated further by legislative leadership this session. The following article remains in its original form.)

A measure that would drastically change how electric utility rate increases are presented to the Oklahoma Corporation Commission is advancing this legislative session. But a bill that would have deregulated investor-owned electric utilities and a proposal that would have allowed so-called “right of first refusal” requirements for certain new electric transmission projects failed to get a hearing by last week’s committee deadline.

The Senate Energy and Telecommunications Committee voted 10-2 on Thursday to advance SB 1103 after its author, Senate President Pro Tempore Greg Treat (R-OKC), amended the measure by removing the ROFR language. Shortly after that change was made, Treat told committee members he had just received a text from House Speaker Charles McCall (R-Atoka) saying he supports the bill.

SB 498, by committee chairman Sen. Lonnie Paxton (R-Tuttle), also dealt with ROFR. Treat said SB 498 will not advance this session. It could be a topic for an interim study and possibly receive consideration next year, he said.

As it stands now, SB 1103 deals with establishing a performance-based rate plan in which non-fuel revenue requirements of a rate-regulated electric utility shall be calculated and allocated to the various rate schedules, subject to the jurisdiction of the Oklahoma Corporation Commission. It also would require electric utilities that generate electricity with natural gas to have a firm supply of the fuel to operate their facilities at an 80 percent maximum daily quantity for 14 consecutive days during winter months. Treat said the purpose of that section is to protect customers from adverse weather events and supply chain issues — such as those experienced in February 2021 — and the bill directs the affected utilities to meet this supply goal by December 2026.

Overall, the bill is being praised by Oklahoma’s investor-owned utilities as an efficient way to limit lengthy fights in front of the Corporation Commission, but opponents say it will exacerbate the impact of utilities’ constant rate increase requests and will limit oversight.

During Thursday’s committee hearing, Jeff Cloud, who served on the Corporation Commission from 2003 to 2011, spoke in favor of the amended SB 1103. He said a performance-based review system has been in place for nearly 20 years for natural gas companies and has worked well.

“In its current form, SB 1103 extends the same protections that natural gas customers already enjoy to electricity customers,” said Cloud, now the executive director of Alliance for Secure Energy, which promotes the interests of Oklahoma’s investor-owned electric utilities. “As former chair of the Oklahoma Corporation Commissioner, I believe this process will improve cost predictability and increase regulator efficiency and ability to ensure that customer rates are fair, just and reasonable.”

But not everybody is in favor of the utility-backed proposal. The current chairman of the Oklahoma Corporation Commission, Todd Hiett, sent a note to senators Wednesday urging them to vote against SB 1103. He said there was apparent confusion about his position on the measure and he wanted to make it clear that he did not support it.

“It is important to note performance-based ratemaking is already allowed under the Corporation Commission’s authority,” Hiett said. “There have been numerous requests in litigated cases to have a form of PBR for electric utilities and these have yet to be supported by the Corporation Commission’s Public Utility Division, the attorney general or consumer groups.”

Performance-based rate proposal praised, criticized

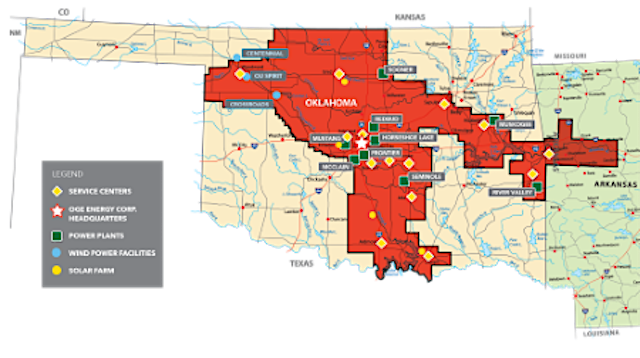

Ken Miller, OG&E vice president of public and regulatory affairs, said SB 1103 would bring increased cost stability to Oklahoma’s electric rates, which are 17 percent below the national average, 8 percent below the regional average, and 13 percent below Texas, according to the Energy Information Administration‘s December figures. OG&E has more than 870,000 customers, mostly in its regulated monopoly territory across central Oklahoma.

“We appreciate Senate Pro Temp Greg Treat for authoring this electric power industry legislation and starting the conversation around rate stability and predictability, which our customers continue to tell us are important to them,” Miller said. “As written, OG&E is supportive of this measure, which provides for gradual infrastructure investments and greater transparency by adding rate reviews annually where they currently only occur every three to five years. If passed, the change would increase the amount of scrutiny electric providers would receive from our regulators.”

A Hall Estill attorney, Tom Schroedter serves as executive director of Oklahoma Industrial Energy Consumers, which acts on behalf of industrial companies and other large consumers of energy. The group opposes the performance-based rate reviews proposed in SB 1103.

“It usurps the authority of the Oklahoma Corporation Commission to determine whether or not a performance-based rate plan is in the best interest of consumers and the public interest,” he said. “So, if Senate Bill 1103 is enacted, the Corporation Commission would have to grant a utility’s application for a performance-based rate plan. So that is taking away the sole authority of the Corporation Commission to regulate public utilities and their rates as they should.”

OIEC has reviewed performance-based rate plans in other jurisdictions and found that they resulted in increased costs to customers and less oversight for utilities while shortening review time of the rate applications.

“It’s a very bad, ill-conceived law that hasn’t been thought out,” Schroedter said. “It has not been studied. It has not been fully considered. And it would be detrimental to Oklahoma.”

Schroedter said SB 1103 would be detrimental to attracting businesses to Oklahoma if it becomes law.

“It would have a chilling impact on economic development in Oklahoma because companies understand these formula rate plans, and that’s why they’re opposed to them,” he said. “They know that these formula rate plans result in increases each year and rate filings each year, and so companies would take notice of that and likely reconsider siting a new facility or expanding an existing facility in Oklahoma.”

Kimber Shoop, director of regulatory affairs for OG&E, said the performance-based rate model outlined in SB 1103 has already been implemented for regulating the state’s natural gas companies.

“This is not an automatic rate increase,” he said. “Unless we can prove that the change every year is fair, just and reasonable, and that the commission agrees with that assessment and issues an order changing the rates, then nothing will change. So, it is going to increase the amount of scrutiny of our rates not have less scrutiny.”

During the last 20 years, OG&E on average has gone between three and four years in between rate cases, Shoop said.

“This is going to be a more frequent review of our costs and will also stabilize rates for our customers,” he said.

With more gradual rate increases, OG&E would be able to plan better, Shoop said. There’s also a provision in the bill that says if an electric utility over earns in a year, then it would directly refund those additional earnings, he said.

“If we over-earn above what the target that the commission sets for us, those monies will flow back to the customers,” Shoop said.

SB 1103 also would require utilities to have a certain amount of storage to handle a 14-day period during the winter months. Shoop said that should help OG&E and other electric utilities from having to buy natural gas on the spot market with the elevated prices that were seen during Winter Storm Uri in February 2021.

OG&E already maintains about 3.5 billion cubic feet of natural gas, or about 70 percent of the 14-day requirement, Shoop said. Before Uri, OG&E had only a small amount of storage because the price of natural gas had been so low and so stable for so long, he said. The company’s failure to plan and prepare for a catastrophic event was widely criticized by customer advocates and others following the historic 2021 storm.

Wayne Greene, a spokesman for Public Service Company of Oklahoma, also said SB 1103 would increase transparency and stabilize electricity bills for PSO’s nearly 570,000 customers, which reside in three regulated monopoly territory clusters around Tulsa, Lawton and McAlester.

“It also has important safeguards to protect against historic fuel price spikes like those experienced in 2021 with Winter Storm Uri,” he said. “It is an important step toward ensuring electricity service is affordable, secure and reliable now and in the future.”

ROFR likely to be brought up again next year

One of the most controversial components of SB 1103’s proposed changes was removed at the beginning of Thursday’s Senate committee hearing. Under a “right of first refusal” system, existing utilities would have an inherent right to build, maintain and own transmission lines in within their service territory. A new transmission line project would be subject to competitive bidding only if the utility declined to build the line itself.

Treat said the ROFR language in his bill had become a major concern, which was articulated during a meeting with various stakeholders in February.

“I asked everyone who was just there because they opposed the ROFR part to stand up, and it was overwhelming how many people were there just for that,” he said. “And I said let’s not let that be an impediment to getting good policy done, and I pulled it from there.”

Aaron Cooper, OG&E’s manager of corporate communications who previously worked as Treat’s communications director in the State Senate, said OG&E supported the ROFR provision in SB 1103, saying it is critical to protect customers and landowners and provide state regulatory accountability and oversight over the construction of new transmission projects.

“We will continue to have conversations with legislators as they further consider SB 498 as it would create more transparency and cost oversight over transmission projects built in Oklahoma to ensure only prudent and reasonable costs are passed on to customers,” he said.

OIEC’s Schroedter said he is pleased that the ROFR language was removed from the bill.

“Our concern is that it gives the electric utilities a monopoly in building wholesale transmission services, so that basically eliminates competition for construction of new regional transmission lines,” he said. “The monopoly results in higher costs of transmission lines, which then gets charged to utility ratepayers. So the bottom line is the right of first refusal would result in a higher rate for electric utility customers. The language [that had been in SB 1103] is anti-competitive and bad for Oklahomans.”

Deregulation the ‘wrong way to go’

Meanwhile, HB 1602, which proposed deregulation of certain electric utilities, failed to receive a hearing by Thursday’s deadline for bills to pass a committee in their chamber of origin. It would have allowed customers of investor-owned electric utilities that serve more than 100,000 customers to obtain direct access to a competitive retail electric market from which they could buy electricity. The measure would have affected OG&E and PSO customers. Deregulation would have gone into effect Jan. 1, 2025, for commercial and industrial customers, and no later than Jan. 1, 2027, for residential customers.

Rep. Ryan Martinez (R-Edmond) filed the bill and said the House Rules Committee did not hold a hearing on the measure, which will be held over for next session.

“Honestly, the mission was accomplished,” he said. “I introduced that bill knowing that it’s not perfect legislation, but this conversation needs to happen.”

Martinez said he’s hopeful the issue will be explored further during an interim study.

“That’s a good way to dive into some of these more complicated issues,” he said. “Cost to consumers is really my main concern.”

The measures stemmed partially as a result of Winter Storm Uri, which crippled the natural gas supply chain, leading to higher prices that electric utilities had to pay to keep their facilities running as demand rapidly increased because of the freezing temperatures.

In the aftermath of the February 2021 storm, the state agreed to let Oklahoma utility companies securitize the ratepayer debt so that state-marketed bonds could pay off the nearly $3 billion in costs. Charges added to customers’ bills for about the next two decades will then pay off the bonds, which state leaders said would carry lower interest rates than loans taken out by the companies themselves.

With the storm-related debt securitization looming in the background, OG&E recently reported an 18 percent increase in profits in 2022, after imposing hikes that increased the average Oklahoma customer’s bill by more than $23 a month.

Sean Voskuhl, director of AARP Oklahoma, said electric bill increases particularly affect older Oklahomans, who are also facing with higher food and pharmacy prices.

“It’s tough for people struggling to pay their utility bills right now,” he said. “The system’s not perfect at the Corporation Commission, and it’s stacked against residential customers because utility companies have lots of attorneys and lots of staff that camp out there. But we fight that by intervening in rate cases and relying on our members and Oklahomans to voice their concerns at the commission. That’s how we try to level the playing field.”

During Winter Storm Uri in Texas, as a result of the freezing conditions and rapid surge in energy usage, the state’s power grid began to malfunction, leading to cascading failures in the system and widespread blackouts. The infrastructure failure was then compounded by Texas’ energy grid independence and lack of resilience, because most of Texas does not have the option of channeling energy from other states.

During the storm, at least 4.5 million electricity customers in Texas lost power and an estimated 57 people died from hypothermia, the Texas Tribune reported.

“When we talk with our colleagues in Texas, they said, ‘Don’t do [deregulation]. It’s a bad deal,'” Voskuhl said. “I think why electric deregulation may seem as a viable option now is because, the last year and a half, Oklahoma consumers have been dealing with record rate hikes by utility companies. But this is the wrong way to go. It really removes the reliability, accessibility and, really, transparency, because right now as consumers we’re able to contest a rate increase through the regular rate-making progress at the Corporation Commission.”

Electric companies may lure customers with low electric rates at the front end and then in the future set higher rates, he said.

“And you don’t really have the ability to fight those,” Voskuhl said. “While we have been experiencing record rate hikes, we feel having the ability through a rule-making case at the Corporation Commission still gives consumers a fighting chance to hold utility companies accountable for unnecessary rate hikes.”

Still, most Oklahomans would like to shop for their electricity providers in the same way they can shop for a cell phone, internet or TV plan, according to a survey released Friday. The poll of 500 likely Oklahoma voters by Amber Integrated showed 63 percent would like that option compared with 24 percent who would not. The survey, with a margin of error of 4.4 percent, found a majority of all age groups supporting the idea of being able to select their supplier of electricity, from 79 percent of those between the ages of 40 and 49 to 55 percent of those 70 and older.

Most of the people surveyed by Amber Integrated said they think electricity prices are too high. Of those surveyed, 55 percent said electricity prices are high, 29 percent said prices are about right, and 4 percent said prices are low.

PSO’s Greene said HB 1602 would have taken away important protections for Oklahoma utility customers, while creating the risk of higher prices and diminished reliability.

“PSO already participates in a competitive marketplace to serve customers with the most cost-effective, reliable power available,” he said. “Adding a middleman to the process just adds to the cost.”

Cloud, the former corporation commissioner, said talk of deregulating electric utilities has been around for more than two decades. It was a major topic when he first ran in 2002 to serve on the Corporation Commission.

“Oklahomans then were very much opposed to it,” he said. “They want the commission to have oversight over electricity. They want it to be elected. I don’t believe Oklahomans’ position on that has changed whatsoever.

“In the end, Oklahomans want reliable electricity at the most affordable price, and I believe the current system is much better at providing both of those goals instead of restructuring into a deregulated market.”

(Editor’s note: Both AARP and Public Service Company of Oklahoma have been charitable sponsors of the Sustainable Journalism Foundation since 2020.)