(Update: On Friday, May 26, a pair of bills in the Fiscal Year 2024 budget deal failed their votes in the Senate. HB 1022X, to create a new “judicial performance evaluation” process, failed 15-29, and HB 1026X, to raise statewide official pay following the next election, failed 13-31. In response to the Senate’s votes, House members chose not to hear three bills that same day: SB 11 to turn the Tourism and Recreation Commission back into a governing body; SB 22 to establish a fund and rules for the Oklahoma Museum of Popular Culture to receive $18 million contingent on matched fundraising; and SB 27 to direct $12.5 million to the County Community Safety Investment Fund, which was created to reallocate criminal justice reform savings to community mental health efforts in line with State Question 781. The following article remains in its original form from May 23.)

A party-pooping Monday turned into a tea for two on Tuesday during the final week of the Oklahoma Legislature’s regular session.

Lawmakers advanced the remainder of their Fiscal Year 2024 state budget through a concurrent special session today after Monday’s planned meetings of the Joint Committees on Appropriations and Budget never happened. Instead, legislative leaders hashed out even more agreements — including elimination of the state’s franchise tax and a $145 million site-prep investment aimed at luring a Panasonic battery plant — during tense talks between the chambers and with Gov. Kevin Stitt.

Bills began moving Tuesday morning, with JCAB meetings running late into the afternoon with a revised agenda that suddenly included the Panasonic project and a pair of tax reduction measures.

HB 1038X sends $145 million to the Department of Commerce “to provide site improvements and construction of needed facility upgrades at an industrial park in the state, in order to benefit the state and its citizens by attracting large-scale economic activity and development that creates a substantial number of jobs in the state.”

While Panasonic’s signed agreement with the state in April specified a $245 million request “for the benefit of the company,” lawmakers expressed optimism that the $145 million figure would meet identified infrastructure needs, which could include roadwork, a hazmat facility and moving a rail line and a water stream.

“I feel very comfortable that we are back now on the original deal we offered them before they chose Kansas (for the first plant),” Senate Appropriations and Budget Chairman Roger Thompson (R-Okemah). “I think it’s going to be in their court. Whenever we look at our original offer, they thought that was good enough to take to Tokyo.”

The Legislature’s agreement to provide additional funding for the Panasonic project — on top of $698 million of incentives already made available to the company — comes one day after the Italian company Enel formally announced its plans for a $1.8 billion solar panel plant to be built in the Inola area.

“Enel’s expansion is a huge win for Oklahoma, and I’m thrilled by their record investment in our state’s economy and workforce, that will have a lasting legacy and continue to impact Oklahomans for generations,” Stitt said in a press release.

Final talks ‘about as functional as the rest of session’

The 50-plus bills advanced Tuesday by both the House and Senate JCABs are expected to hit their respective chamber floors Wednesday. After a constitutionally required day to receive the measures in opposite chambers on Thursday, lawmakers could send their slate of budget bills to Stitt on Friday, the final day of regular session. Legislators ran the bills through special session to ensure they have time to consider overriding potential vetoes from Stitt, and they are scheduled to return to the Capitol for that purpose on Monday, June 12.

Legislators initially revealed 46 bills minutes before midnight Monday, but the last-minute flurry of fiscal activity provided further evidence that House and Senate leaders have not been on the same page this year.

Six bills were amended between Monday and Tuesday — including HB 1004X‘s general appropriations bill — and a dozen new measures arrived on the scene, including the tax bills, one-year state-tribal compact extension agreements and a State Department of Education budget limits bill prohibiting Superintendent Ryan Walters from rejecting federal grants previously pursued by the agency.

House Appropriations and Budget Common Education Subcommittee Chairman Mark McBride (R-Moore) told NonDoc the federal grant requirement was his idea.

“I thought that was needed to put something into the education budget so we make sure that we secure all the federal funds that we can because these are tax dollars that we’ve all paid that we need to come back to the classroom to educate our kids,” McBride said.

Monday afternoon, as befuddled lobbyists wondered whether drama between the chambers could somehow get worse, Senate negotiators trudged to and from the House speaker’s office, and various new versions of bills appeared online, including a fourth effort at a general appropriations bill that had originally included quite the scrivener’s error. (While lawmakers meant to appropriate $531,000 to the Department of Environmental Quality for engineering expenses related to demolishing a problematic parking garage, the bill’s original draft offered up $531 million.)

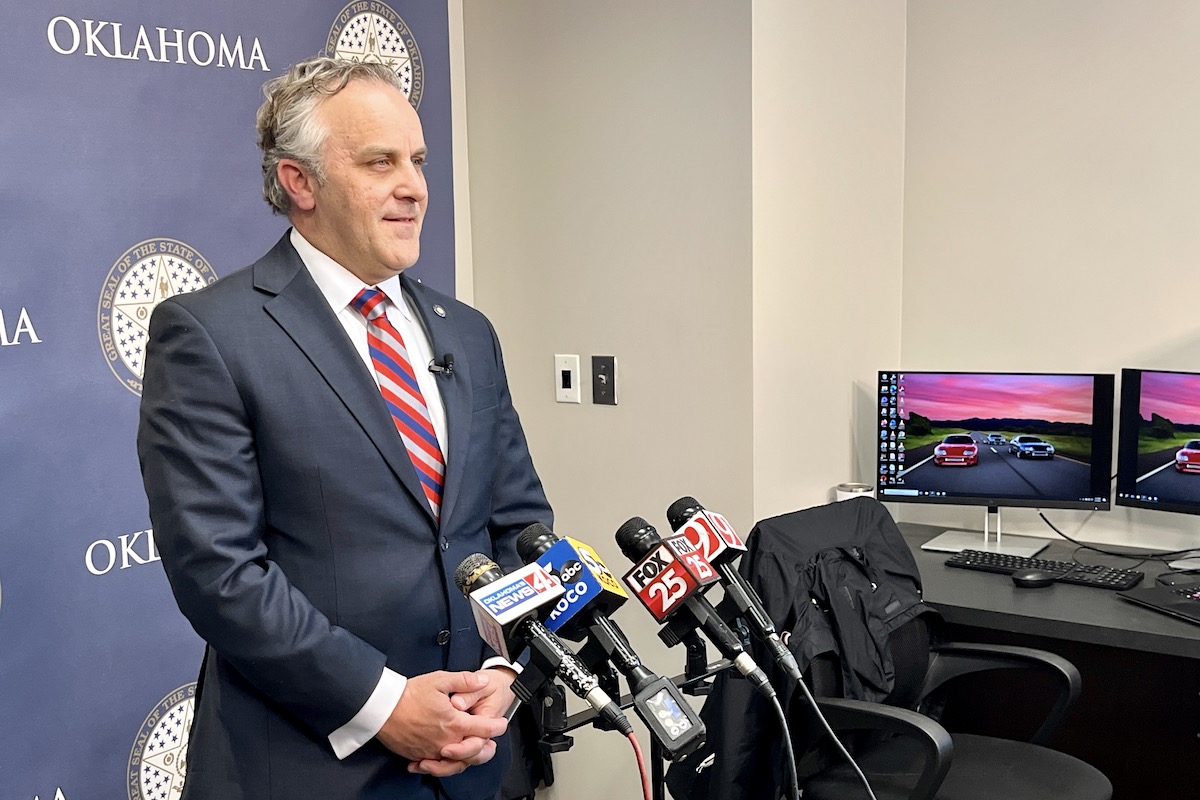

Asked to describe Monday’s closed-door conversations between the chambers, House Appropriations and Budget Chairman Kevin Wallace (R-Wellston) replied, “About as functional as the rest of the session.”

In the end, legislators advanced more than 50 bills during Tuesday’s JCAB meetings, including a pair of major proposals aimed at creating lasting impacts with one-time appropriations: a new $215 million affordable housing project and a new $600 million fund to self-finance capital projects at state agencies.

“Overall, it’s a great budget from what I’ve seen. There’s no such thing as a perfect budget, but I think this is pretty darn close,” House Majority Floor Leader Jon Echols (R-OKC) said Monday. “Historic investments in education, some great support of public safety, some good work with mental health. I mean, overall, it’s a great budget. It’s easy to vote for.”

The House and Senate agreement totals more than $13 billion in overall allocations, with much of that being one-time spending instead of across-the-board agency increases. The education sector receives the lion’s share of that increase.

Fresh from their major education deal — which increases common education appropriations by $625 million annually, provides $53.3 million more to school districts per year for three years, and creates a tax credit program with a FY 2024 cap of $155 million (climbing to $255 million for FY 2026) — lawmakers have touted their overall education budget as about $1 billion higher than last year.

To get there, legislators point to appropriations for teacher raises through the Department of Corrections, the Office of Juvenile Affairs and the Department of Rehabilitation Services. They also emphasize an additional $130 million for the State Regents for Higher Education to enable faculty pay raises at colleges and universities. Engineering programs will also see new money for expansion.

According to Wallace, the two tax-related bills revealed and advanced Tuesday are estimated to have a nearly $70 million impact on future revenues:

- HB 1040X, which modifies a tax bracket for joint filers in an effort not to have a “penalty” for marriage. The change is estimated to reduce state collections by about $14.7 million annually;

- HB 1039X, which eliminates the state franchise tax on businesses starting in the 2024 tax year. The move is estimated to reduce state revenues and save businesses about $55 million annually.

‘It’s a big deal’: $215 million dedicated to new housing program

Among the largest single investments in non-education matters is a $215 million appropriation for three new programs aimed at incentivizing affordable housing construction around the state.

HB 1031X creates the Oklahoma Housing Stability Program, the Homebuilder Program, and the Oklahoma Increased Housing Program. The bill directs the Oklahoma Housing Finance Agency to administer the programs and promulgate rules. The Homebuilder Program authorizes loans as low as zero percent for homebuilders of single-family units. The Increased Housing Program allows developers to apply for “gap financing” for single-family and multifamily housing projects. It also allows homebuyers to apply for a grant to assist with making a down payment on a home. The bill specifies that all three programs be applied in rural and urban areas and that preferences be provided to areas previously declared federal disaster zones.

With OHFA tasked with creating rules for the new programs, questions about down payment and eligibility percentages are not answered in the bill. Lawmakers, however, said the idea came from OHFA itself and that the agency’s white paper recommends single-family homes between $140 per square foot and $160 per square foot and that homebuyer eligibility for down payment assistance be capped at income equal to or less than 120 percent of the state median.

“There is a need. This isn’t going to get housing for the homeless. However, this will be for workforce development houses — houses that are from 1,300 to 2,200 square feet, and guess what? When you put more housing out there that is affordable, you will open up other housing,” said Wallace, who has been the leading House proponent of the housing effort. “There’s a housing shortage, period, every place I look, and I’m from rural Oklahoma. Every time a new teacher comes in, there’s never a place they can live. There’s never any open housing.”

If fully subscribed, the program could run for about five years on the $215 million investment, according to Senate Appropriations and Budget Vice Chairman Chuck Hall (R-Perry).

“It’s a big deal,” Hall said of the housing proposal.

Wallace coauthored a prior version of the new housing program with Hall, and he said Monday’s conversations between the chambers and with the governor revealed hesitation to approve the concept.

“[The Housing Finance Agency] gave me the budget number of basically $265 million. But since everybody basically seems to be afraid and not real positive about the deal because they haven’t worked on it, I agreed to cut $50 million out of it and start with a lower number to appease the governor and the Senate some,” Wallace said. “Once the program gets up and running, I think at some future date there will be additional funds put in it.”

More details about overall appropriations in HB 1004X and other measures are included in a bill summary spreadsheet posted on the Legislature’s website.

“This bill will leave us with anticipated savings of [about $3.64 billion],” Thompson said while presenting the general appropriations bill.

Leaving a ‘legacy’ for future legislative sessions

The other largest one-time investment in the Legislature’s FY 2024 budget stemmed from a compromise over ideas floated by the House and Senate.

HB 1002X would create the Legacy Capital Financing Act and Fund “to facilitate advanced financing for current and future capital needs of the state’s agencies, departments, and subdivisions to enable, maintain, or improve the performance of the duties and missions assigned to such entities benefiting the health, safety, and welfare of the citizens of Oklahoma.”

The idea was initially outlined in a March memo from House fiscal director and counsel John McPhetridge.

“Oklahoma is currently in possession of a large amount of non-recurring revenue; which could prove problematic in future budgets if fully plowed into the operational budget of the state. In an effort to avoid increasing the operating budget of the state in an unsustainable manner, the state could instead isolate such funding into a revolving fund and implement a capital and infrastructure budget,” McPhetridge wrote to Wallace in the memo. “By doing so the state could cash finance capital projects from the fund, and reimburse the fund for future use, with appropriations similar to those that would have been required for debt service, had the project been financed through traditional debt instead of cash.”

Unless otherwise specified, all distributions from the new fund shall be returned by state agencies over a 20-year period. The bill allows the Legislature to restructure or suspend agencies’ repayments of such distributions, something that would grant lawmakers flexibility to fill future funding gaps in the event of an economic downturn.

“Talking about the Legacy Fund, some of the housing, things like that, I think you see us being strategic with the one-time dollars,” said House Speaker Pro Tempore Kyle Hilbert (R-Depew). “We don’t know what the future is going to hold, so those aren’t recurring expenses, but (we’re) setting things aside and going to get a good [return on investment] on them.”

In Tuesday’s Senate JCAB meeting, however, Sen. Adam Pugh (R-Edmond) and Sen. John Michael Montgomery (R-Lawton) debated against HB 1002X. Pugh called the idea “dangerous” and urged his colleagues to “be incredibly careful because I am fearful that the state of Oklahoma is creating a central bank.”

Montgomery, who favored a separate idea to put $1 billion into a fund for money-market investment, pointed to Thompson’s name being misspelled at the top of the bill and said “the only thing that frankly gives any merit to this is that we have high interest rates right now.”

Thompson closed debate in favor of the proposal, noting that “we do not print money” and that it was the best idea before legislators even if it was not perfect. He said state buildings need significant investment.

“What we’ve done in the past is not working,” Thompson said. “We deserve better buildings than we have here today.”

The bill advanced from Senate JCAB 17-2, with Pugh and Montgomery casting the only votes in opposition.

In the general appropriations bill, lawmakers specified an initial deposit of $600 million for the Legacy Capital Financing Fund. Lawmakers are immediately using nearly $351 million of that money to finance state agency capital projects that would otherwise hit a bond market with rising interest rates. The projects are outlined in six other bills:

- HB 1009X authorizes the Oklahoma Capital Improvement Authority to dedicate $46 million from the Legacy Capital Financing Fund “for the benefit of Oklahoma Historical Society to facilitate the construction, repair and rehabilitation, and improvements to real and personal property related to existing Oklahoma Historical Society facilities.”

- HB 1011X authorizes the Oklahoma Capital Improvement Authority to dedicate $70 million from the Legacy Capital Financing Fund to the “Office of Management and Enterprise Services to repair, refurbish, and improve the real and personal property of the Jim Thorpe Office Building.” The bill also dedicates $19 million to OMES “to repair, refurbish, and improve the real and personal property constituting the tunnels underlying the State Capitol Office Complex and associated fixtures and equipment.” The bill also dedicates $26.3 million to OMES “to accept transfer of the Kelley Building and Kelley Annex owned by the Department of Human Services and renovate the facilities for lease to a public operator as a day care facility.” The bill also repeals previously authorized bonding authority for those projects.

- HB 1012X authorizes the Oklahoma Capital Improvement Authority to utilize money from the Legacy Capital Financing Fund to fund three of Department of Public Safety projects: $20 million for the Oklahoma Wireless Information Network, $59.6 million for a centralized training facility and $8 million for Oklahoma Highway Patrol facility upgrades;

- HB 1013X authorizes the Oklahoma Capital Improvement Authority to dedicate $79 million from the Legacy Capital Financing Fund “for the benefit of” the Oklahoma State University Veterinary Medicine Authority, to “construct, refurbish or expand animal teaching hospitals and related facilities.” The bill notes that the OSU VMA was authorized in HB 2863, which Gov. Kevin Stitt vetoed on April 26;

- HB 1014X authorizes the Oklahoma Capital Improvement Authority to utilize $17.6 million from the Legacy Capital Financing Fund “to the Office of Management and Enterprise Services for the benefit of the Oklahoma Department of Libraries, to construct, refurbish, or expand the facilities utilized by the Department of Libraries”;

- HB 1032X authorizes the Oklahoma Capital Improvement Authority to dedicate $4 million from the Legacy Capital Financing Fund “to facilitate the construction of new or expanding training facilities” for the Council on Law Enforcement Education and Training.

Mental health transports, family care credit, Thunder incentives

Other budget-related bills unveiled late Sunday night and tweaked Monday include an effort to improve transportation processes for people needing mental health treatment and a six-week paid maternity leave program for state employees. (As part of their education deal, lawmakers already created a similar maternity leave program for public school employees.)

Lawmakers also advanced a new tax credit for family caregivers, which is somewhat capped at $2,000 per year for family members who provide care to disabled adults age 62 and above in a private home setting. (The cap is $3,000 for family members caring for a veteran or someone experiencing dementia.)

They also advanced a pair of incentive programs benefiting the bottom line of the Oklahoma City Thunder.

Those proposals and other items are included in other JCAB bills advanced Tuesday:

- SB 11X re-expands the duties of the Oklahoma Tourism and Recreation Commission from advisory to governance and allows for the governor to remove an appointee “with cause.” The Legislature had made the commission an advisory body in 2018, but the Swadley’s scandal and questions about agency spending spurred lawmakers to consider undoing their prior action;

- SB 12X modifies rules regarding the assessment and transport of people that a law enforcement officer reasonably believes need mental health treatment. It removes a 30-mile minimum requirement for the Department of Mental Health and Substance Abuse Services or a contracted entity to transport the individual instead of law enforcement;

- SB 13X extends from 15 to 30 years the eligibility of sports teams — functionally, the Oklahoma City Thunder — to qualify for payments under the Oklahoma Quality Jobs Act;

- SB 14X doubles from $15 million to $30 million the Oklahoma Department of Commerce’s allowed cumulative inducements for “entertainment district tenant parties that have a total spend of at least $1 million;

- SB 15X takes from $500 to $2,500 the annual fee charged on manufacturers of controlled dangerous substances, including marijuana grow operations;

- SB 16X establishes a six-week paid maternity leave program for state employees with at least two full years of service prior to the birth or adoption of a child;

- SB 17X extends for five years through 2029 a tax credit for entities owning railroads in Oklahoma;

- SB 18X creates the Medical Marijuana Tax Fund and removes prior apportionment language for use of marijuana tax revenues. The measure is part of a broader move to make the Oklahoma Medical Marijuana Authority a stand-alone agency outside of the State Department of Health;

- SB 19X creates the Family Representation and Advocacy Act and prescribes rules and requirements for “court-appointed legal and interdisciplinary representation to children, indigent parents, legal guardians, or Indian custodians in proceedings governed by the Oklahoma Children’s Code.”

- SB 21X creates the Oklahoma Employment Security Commission Information Technology Innovation Revolving Fund;

- SB 22X creates the Oklahoma Museum of Popular Culture Supplemental Revolving Fund and states that no expenditures from the fund may be made until $18 million of additional money is raised via private fundraising or appropriation from other governmental entities;

- SB 23X modifies provisions of the Ambulance Service Provider Access Payment Program to distinguish between fee-for-service contracts and capitated contracts. The change reportedly relates to air ambulance services;

- SB 24X creates the Oklahoma State Bureau of Investigation Centennial Revolving Fund to support the agency’s celebration of its centennial;

- SB 27X directs $12.5 million to the County Community Safety Investment Fund, which was created to reallocate criminal justice reform savings to community mental health efforts in line with State Question 781;

- SB 28X establishes budget limitations for the State Regents for Higher Education, including $17.4 million for the state’s scholarship program and teacher employment incentive program, $12.5 million for establishing a National Guard Educational Assistance Fund, $48.9 million for faculty pay raises, $20 million for expanding engineering programs, $5 million for application-based health care, $12.5 million for workforce development initiatives, $12.5 million for student success initiatives and $200,000 to establish a food pantry;

- SB 29X lowers a matching-rate requirement for an early childhood education pilot program — Educare — serving at-risk children administered by the State Department of Education;

- SB 31X establishes line-item funding requirements for the Oklahoma Historical Society, including $18 million for the Oklahoma Museum of Popular Culture and $5 million for the Native American Cultural and Educational Authority;

- SB 32X establishes line-item funding requirements within the budget of the Oklahoma Health Care Authority, including $30 million “to provide grant funding to providers for the one-time connection to the state designated entity for health information exchange.” The bill also directs $47.7 million be used to increase rates for long-term care facility care by $37 per day and rates for “intermediate care facilities for individuals with intellectual disabilities” by $17 per day. It directs $200 million to be used for one-time funding to critical access hospitals and hospitals that participate in the Supplemental Hospital Offset Payment Program (SHOPP). The bill also establishes new rules regarding the use and management of other funds by the Health Care Authority;

- SB 33X establishes line-item funding requirements within the budget of the Oklahoma Department of Human Services, including $10 million for home-based services for developmentally disabled individuals and $5.6 million for the Child Abuse Multidisciplinary Account. The bill also makes permanent through June 30, 2024, a $5 supplemental daily reimbursement rate for childcare providers;

- SB 34X functionally affirms a sales tax exemption for the purchase of broadband equipment;

- SB 35X directs the Tourism and Recreation Department to “make available matching funds to multicounty organizations” pursuant to state statute;

- SB 36X establishes budget limitations for the State Department of Education, including specifications for a school security assessment ($1.4 million), a software suite at the state agency ($2 million) and equipping all schools with inhalers ($250,000);

- SB 37X moves Service Oklahoma out from under the Office of Management and Enterprise Services to become a stand-alone agency. It refers to tag agents or motor license agents as “licensed operators” and establishes payment percentages to them. It provides for Service Oklahoma to make compensation changes for license agents annually before the last day of September;

- HB 1006X establishes line-item funding requirements within the budget of the Oklahoma Department of Agriculture, Food and Forestry;

- HB 1007X establishes line-item funding requirements within the budget of the Oklahoma Department of Commerce, including specific allocations to programs at Seminole State College (for a rural business and resource center), Murray State College (for a gunsmithing technology degree) and Northeastern A&M College (for an agriculture rodeo program);

- HB 1008X increases from $25,000 to $30,000 the maximum income cap for heads of household claiming a certain property tax homestead exemption;

- HB 1023X authorizes the Oklahoma Department of Environmental Quality to demolish its long-problematic parking garage at its Oklahoma City headquarters;

- HB 1025X increases from 50,000 to 75,000 the county population threshold for the Rural Economic Transportation Reliability and Optimization Fund. (A prior version of the bill drafted by the House proposed establishing seven priority projects, but Monday’s negotiations with the Senate resulted in those projects — near Jay, Idabel and Hochatown — to be removed from the bill);

- HB 1029X creates the Caring for Caregivers Act, which establishes a new tax credit starting in the 2024 tax year for family members who act as caregivers for disabled Oklahomans who are age 62 and up and who live at a private residence. The bill allows for a tax credit up to 50 percent of eligible caregiver costs, capped at $2,000 per year for most participants and $3,000 per year for those caring for veterans or people dealing with dementia. The bill provides a flexible cap of $1.5 million total for the program annually, with adjusted calculations made in future years if a prior year exceeds that amount;

- HB 1030X creates the Oklahoma Accelerator Revolving Fund for the Oklahoma Center for the Advancement of Science and Technology.

In general appropriations, the Oklahoma Educational Television Authority received its same appropriation as last year, previewing the Legislature’s pending decision on whether to override Stitt’s veto on a bill extending the agency’s sunset.

The Oklahoma Department of Veterans Affairs also will receive an $11.6 million appropriation increase following revelations about the ODVA’s finances, as well as another $10.8 million for completion of the delayed veterans home project in Sallisaw. Lawmakers are providing the University Hospital Authority and Trust an additional $122 million, which will functionally provide a $96 million one-time appropriation to support uncompensated indigent care in the OU Health system.

“We are supposed to be paying for indigent care. We chose OU to do that,” Thompson said Tuesday. “There’s a lot of stuff in the budget. Education being over $1 billion (increase). Health care is huge. We’ll add $45 million that will go into our nursing homes. I think that’s a great thing to do. You heard a conversation on roads. We’re adding $200 million to that. That’s on top of the $590 million that we already have there on state-appropriated funds, plus another $190 million that we put in the ROADS Fund, so that’s close to $1 billion appropriate for roads in Oklahoma.

“It’s not a perfect budget. I’ve never seen one. But it does address some needs of the state.”

More ARPA funding moves for nonprofits, teacher training

Lawmakers are also advancing seven additional bills for appropriating American Rescue Plan Act funds. Those measures are:

- HB 1017X creates the “emergency relief and impacts grant program” within the Oklahoma Department of Emergency Management and Homeland Security, which will receive $25 million;

- HB 1018X appropriates $6.5 million to the Oklahoma Center for Advancement of Science & Technology for expanding three projects: 36 Degrees North ($5 million), The Verge OKC ($1 million) and an effort for rural entrepreneurial support ($1 million);

- HB 1019X appropriates $968,000 of ARPA funding to the Department of Commerce for the Workforce Coordination Revolving Fund utilization program, which aims to revise and improve the state workforce coordination program;

- HB 1020X appropriates $25 million of ARPA funding to the new fund at the Oklahoma Department of Emergency Management and Homeland Security created by HB 1017X;

- SB 38X appropriates $5 million of ARPA funds to the State Regents for Higher Education to support a Teachers Accelerated Program that will invest in the training of high-demand educator categories, such as English as a Second Language, math, science and special education. The program is also set to support micro-credentialing in educator fields;

- SB 39X appropriates $500,000 of ARPA funds to the Healthcare Workforce Training Commission for support and expansion of the Northwestern State University nursing program by purchasing equipment for instruction. The bill also implements other requirements on the commission;

- SB 40X appropriates $17.5 million of ARPA funding to the Department of Human Services to support nonprofits, including expansion of the Women in Recovery program into five additional counties ($10.3 million), ReMerge expansion into areas of rural Oklahoma ($3.8 million), capacity expansion at Special Care ($2.5 million) and capacity expansion at New Leaf Transition Academy ($1 million);

‘Judicial performance evaluation’ revealed, tribal compacts extended two years

Five bills deal with issues related at least tangentially to the state’s court system, including a major new program aimed at providing judges and appellate court justices with a “performance evaluation.”

The measures include:

- HB 1022X creates the Office of Judicial Performance Evaluation “to provide justices and judges with useful information concerning their own performances” and to “conduct statewide judicial performance evaluations using uniform criteria and procedures pursuant to the provisions of this act.” The bill also creates a governing Board of Judicial Performance Evaluation and establishes broad exemptions from the Open Meeting Act and the Open Records Act. The bill directs the new office to create and gauge the validity of “surveys to evaluate the performance of justices and judges which shall be completed by attorneys, jurors, represented and unrepresented litigants, law enforcement personnel, attorneys within the district attorneys’ and public defenders’ offices, employees of the court, court interpreters, employees of probation offices, and employees of local departments of social services.” The bill establishes six criteria for judicial evaluation: integrity, legal knowledge, communication skills, judicial temperament, administrative performance, and service to the legal profession. The bill specifies that “members of the Board of Judicial Performance Evaluation and employees of the Office of Judicial Performance Evaluation shall not publicly discuss the performance evaluation of a particular justice or judge.”

- HB 1024X raises from $20 per day to $50 per day the rate paid to jurors in Oklahoma;

- HB 1026X connects statewide officeholder pay to judicial pay beginning in 2025. The bill equates the governor’s salary to the chief justice of the Oklahoma Supreme Court, a functional raise of roughly $25,000. It also equates the attorney general’s salary to the salary of the presiding judge of the Court of Criminal Appeals, which is a functional $71,000 raise. It also equates the salaries of all other statewide elected officials to that of district judges;

- HB 1027X modifies components of the full-time service calculation for state pensions involving judges and justices. It makes judicial branch employees eligible for the state’s longevity pay plan;

- HB 1028X modifies payments and conditions for the Workers Compensation Commission Revolving Fund;

A pair of other bills advanced extend state compacts with tribal nations one year. Prior versions of such legislation advanced through House JCAB proposed extending the compacts until January 2028, but the Senate committee did not hear them. The two bills advanced Tuesday are:

- HB 1005X extends state compacts with tribal nations regarding motor vehicle registration fees through Dec. 31, 2024;

- SB 26X extends state compacts with tribal nations regarding tobacco taxes through Dec. 31, 2024. A prior effort to extend the compacts until January 2028 did not receive a Senate committee hearing.

(Correction: This article was updated to correct reference to the proposed length of extension of state-tribal compacts and to correct description of SB 32X.)