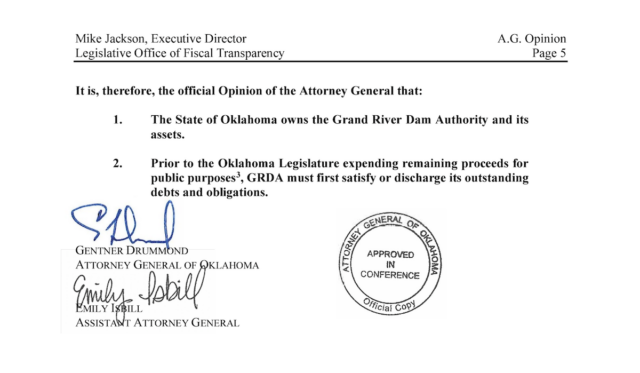

As the Grand River Dam Authority continues to pursue increased bonding capacity and power-generation growth, Attorney General Gentner Drummond has issued an opinion affirming the state of Oklahoma’s ownership of the public power utility’s assets. The new AG opinion also says any legislative-directed sale of GRDA assets would require the state to satisfy and discharge any debts and obligations, including loans taken out for power plant projects and contracts with commercial and municipal customers who purchase electricity from the non-appropriated state agency.

“GRDA is a creature of statute, meaning the Legislature may amend GRDA’s powers and duties through the normal legislative process as opposed to submitting the question to a vote of the people,” Drummond wrote in the AG opinion dated May 25. “After all, Article 5, Section 1 of the Oklahoma Constitution vests ‘[t]he [l]egislative authority of the state’ in the Legislature, subject to the people’s reserved powers. The Constitution also grants the Legislature expansive authority ‘extend[ing] to all rightful subjects of legislation, and any specific grant of authority in this Constitution, upon any subject whatsoever, shall not work a restriction, limitation, or exclusion of such authority upon the same or any other subject or subjects whatsoever.’

“Consequently, the Legislature may, in its sound discretion, direct GRDA to sell or otherwise dispose of some or all of its assets. However, state law and obligations assumed by GRDA necessitate proper distribution of any proceeds from the sale or disposition of GRDA assets. Title 82, Section 861A of the Oklahoma Statutes provides that GRDA ‘is subject to the laws of the state as they apply to state agencies except as specifically exempted by statute.'”

Drummond released his opinion during the final week of the 2023 regular legislative session, but the question had been asked of the Attorney General’s Office more than two years earlier in February 2021 when Mike Hunter held the office.

Mike Jackson, the executive director of the Legislative Office for Fiscal Transparency, told NonDoc that he requested the AG opinion during the first month of the 2021 legislative session at the direction of House and Senate leaders, who were preparing to hold task force meetings related to GRDA’s request for an increase in its bond capacity.

“Legislative leadership asked for clarification in advance of consideration of the bond cap proposal,” Jackson said, noting that lawmakers also previously asked him to request AG opinions related to the Tobacco Settlement Endowment Trust and the state’s Central Purchasing Act.

AG opinions issued for TSET, Central Purchasing Act

Attorney general opinions are issued to legislators and other public officials when they ask questions about the proper interpretation of state law. Once issued, AG opinions function as binding legal guidance until state statute is changed by the Legislature or a court rules on the topic in question.

When Drummond assumed office in January, he inherited a backlog of AG opinion requests from public officials. In 2021, after Hunter resigned and John O’Connor was appointed attorney general by Gov. Kevin Stitt, the office issued only one opinion. In 2022, only eight AG opinions were released. With Drummond’s GRDA opinion dropping May 25, his office has already issued eight through the first five months of 2023.

Two of those other opinions were also requested by Jackson and legislators regarding the Legislature’s authority over TSET funds and the Office of Management and Enterprise Services’ duties under the Central Purchasing Act.

On April 13 — one week after a LOFT Oversight Committee hearing with OMES officials about purchases made by state agencies — Drummond issued an AG opinion that OMES and the state purchasing director are required to review purchases coded by state agencies as “exempt” from Central Purchasing Act requirements.

On May 10, Drummond issued an opinion regarding how funds in the Tobacco Settlement Endowment Trust may be used. In responding to three questions, Drummond concluded that:

- Article 10, Section 40 of the Oklahoma Constitution does not allow the Legislature to “authorize or formally approve” the use of TSET funds, which were and continue to be derived from the 1998 master settlement agreement in a multi-state tobacco lawsuit;

- The Legislature may formally recommend a use for TSET funds to the trust’s board of directors;

- TSET fund expenditures to benefit the state’s Medicaid program are allowed under the Oklahoma Constitution.

In November 2020, nearly 59 percent of Oklahoma voters rejected State Question 814‘s proposed constitutional amendment that would have directed TSET to fund state-borne costs for Medicaid expansion, which voters had approved months earlier.

GRDA bond capacity question tied to Panasonic proposal

Jackson, the LOFT director, asked the Attorney General’s Office to clarify two points related to the GRDA: First, does the state of Oklahoma own GRDA’s assets? And second, if the Legislature were to direct GRDA to sell some or all of its assets, how would the proceeds be distributed?

The Oklahoma Legislature created GRDA in 1935 to control, store, preserve and distribute “the waters of the Grand River and its tributaries, for irrigation, power and other useful purposes and reclamation and irrigation of arid, semiarid and other lands needing irrigation, and the conservation and development of the forests, minerals, land, water and other resources and the conservation and development of hydroelectric power and other electrical energy, from whatever source derived, of the state of Oklahoma.”

Governed by a seven-member board of directors, GRDA now operates three hydroelectric power plants and, in recent years, built a new gas power plant in Chouteau that allowed one of the agency’s two coal-fired plants to be decommissioned. GRDA sells power to electric cooperatives, 15 municipalities and more than 80 industrial clients, including companies like Google at the MidAmerica Industrial Park in Pryor.

As Gov. Kevin Stitt and the Oklahoma Department of Commerce have attempted to recruit major international companies — such as Panasonic, Volkswagen and Enel — to build manufacturing facilities in the state, access to low-cost electricity from GRDA has been a major selling point, often to the chagrin of legislators in other parts of the state who wonder why their backyards have not been in consideration.

GRDA has its own top legislative priority on the line when it comes to ongoing negotiations between state leaders and Panasonic, which has sought a variety of incentives to build a roughly $4 billion electric vehicle battery plant at the MidAmerica Industrial Park. Last week, lawmakers appropriated the Department of Commerce an additional $145 million for infrastructure investments associated with the potential Panasonic plant, although the company had requested $245 million.

That $145 million of infrastructure money has been offered in addition to $698 million lawmakers appropriated last year to a special Large-scale Economic Activity and Development Fund they created as a way to front-load existing state development incentives for Panasonic.

But as executive branch leaders have pushed for the Panasonic project over the last three years, GRDA has sought a separate authorization from the Oklahoma Legislature: an increase in its capacity to take on bond debt for financing new or expanded electricity generation.

After contentious negotiations, a 2021 legislative task force recommended a bond ceiling hike. Although GRDA sought nearly to double its bond capacity from $1.41 billion to $2.8 billion in 2021, lawmakers ultimately approved a 2022 bill that would only increase GRDA’s bond capacity to $2 billion contingent upon the Department of Commerce approving an application under the LEAD Act for a project the size of the proposed Panasonic plant.

The contingency-filled arrangement — complicated further by the LEAD Fund being swept back into the General Revenue Fund until a binding contract is signed between the state and Panasonic — has left onlookers confused about how much bonding capacity and electric generation capacity GRDA has at its disposal.

Dan Sullivan, the CEO of the Grand River Dam Authority, issued a statement saying that Drummond’s new AG opinion helps protect the public interest.

“We appreciate the attorney general’s opinion, which clearly protects the rights of GRDA bondholders and customers,” Sullivan said. “As rightly noted in the opinion, GRDA issues low-cost, tax-

“Additionally, the Oklahoma Constitution guarantees that the power purchase and sale agreements between GRDA and its wholesale municipal and cooperative customers, as well as retail commercial and industrial customers located in the MidAmerica Industrial Park, will never be impaired as the result of any action by the Legislature.”