In promoting their community, Edmond residents and officials often champion public safety services funded at per-capita rates higher than most Oklahoma cities.

Portions of that above-average funding, though, stem from a confusing 2000 ballot question that has redirected revenue for decades away from the city’s general budget and to Edmond police and fire departments in a manner voters at the time never could have foreseen. While it has supported public safety services, it has also created broader implications for the city’s budget.

Some previous Edmond leaders, including the city manager who helped draft the ballot question, argue the departments are now receiving funds that the electorate never intended to give them. With a mystery unsolved as to why the 2000 ballot title failed to disclose the full details of the electoral question, the situation continues to have funding implications for a city facing a slate of votes on tax proposals this year and possibly next.

Passed in 2000, the ordinance established a three-eighths cent sales tax to fund public safety personnel and equipment. But while that portion of the proposal was described in the ballot title, a separate component was not: A requirement that the Edmond Police Department and Edmond Fire Department perpetually receive specified percentages of the city’s General Revenue Fund that combine to equal about two-thirds of GRF dollars.

As passed, the ordinance also applied to dedicated revenues such as Edmond’s lodging tax and the medical marijuana sales tax, which was not even authorized by law until voters legalized medical cannabis in 2018.

To comply with the 2000 ordinance’s funding mandates, the city has had to respond to general revenue increases by dedicating additional dollars to EPD and EFD, thus reducing money available for other city departments.

Randel Shadid, who served as Edmond’s mayor from 1991 to 1995, said voters were unaware the 2000 ballot question would mean forever providing EPD and EFD with additional general fund money based on the establishment of new or increased taxes in the future.

“They’re getting money that I personally think they were never entitled to,” Shadid said. “I don’t think that was ever the intent of the electorate.”

Now, with inflation stretching budgets and and nearly all sales tax revenues from the city’s Capital Improvement Project funds obligated for several years, city leaders are seeking different revenue sources to fund more projects. However, the unusual 2000 ordinance means upcoming tax elections could have broader financial implications for the city.

Edmond residents are likely to decide on several revenue-based ballot questions over the next few years, such as:

- A Nov. 5 vote to authorize general obligation bonds for quality-of-life and road improvement projects;

- A potential fall 2025 election that could permanently dedicate a portion — less than 2 percent — of the city’s sales tax base for a proposed light rail project through Edmond, Norman and Oklahoma City;

- Potential renewal of the half-cent 2017 Capital Improvement Project tax scheduled to sunset March 31, 2027; and

- Potential renewal of a one-cent sales tax dedicated to the General Revenue Fund scheduled to sunset March 31, 2027.

Except for the GO bonds, these upcoming tax decisions could — by default — affect funding to Edmond police and fire, even as the city grapples with a financial gap for its capital improvement projects.

Underscoring the peculiarities of the 2000 ordinance, the city has created exceptions as recently as 2021 when Edmond leaders struck an agreement with police and fire unions that exempted a recently approved a 2 percent lodging tax increase from calculations about general fund dollars set aside for the police and fire departments.

That exemption, however, only applies to increases to the lodging tax beyond its original 4 percent rate. The parties agreed that “the amount of the increase over and above 4 percent shall not be considered as revenue for the purpose of calculating” EPD and EFD revenue shares.

A similar memorandum of understanding was signed in 2017 to prevent EFD and EPD from receiving two-thirds of new revenue generated by plot price increases at Gracelawn Cemetery.

“The parties acknowledge that since Ordinance No. 2575 was passed in 2000, there have been changes in the nature and sources of General Fund revenues,” that MOU read.

‘The real question is: Why did it not appear on the ballot?’

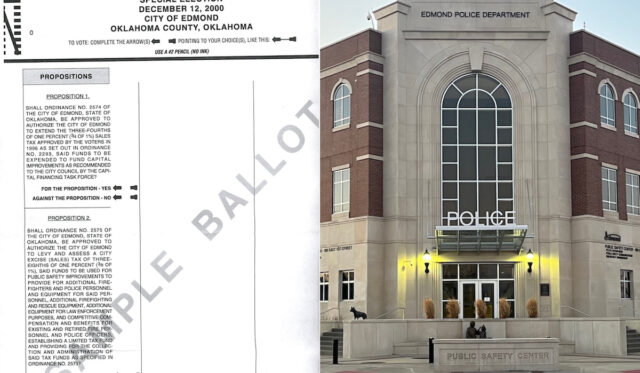

Ordinance No. 2575 passed with 59 percent support Dec. 12, 2000. It mandates 30 percent of general fund revenues for EFD and 36.8 percent of general fund revenues for EPD, in addition to the public safety sales tax. That language is described within section 4 of Ordinance 2575, titled “purpose of revenues.” However, those funding percentages were not described in the ballot title provided to voters in December 2000.

While the ballot question described the new 0.375 sales tax percentage to be allocated between EFD and EPD, respectively, Section 4 of Ordinance No. 2575 also contained much broader language:

Future funding for the Fire Department shall, at a minimum, be set at an amount equal to the projected revenues generated by the tax established by this Ordinance (2/8 of 1%), plus the baseline funding equal to 30 percent of the General Fund revenues. General Fund revenues are those which currently come from the following sources: taxes, licenses and permits, fines and forfeitures, charges for services, interest and miscellaneous revenues. Expenditures will not be charged against the public safety tax revenues until said 30 percent General Fund revenues have first been used or encumbered.

Future funding for the Police Department shall, at a minimum, be set at an amount equal to the projected revenues generated by the tax established by this Ordinance (⅛ of 1%), plus the baseline funding equal to 36.8 percent of the General Fund revenues. General Fund revenues are those which currently come from the following sources: taxes, licenses and permits, fines and forfeitures, charges for services, interest and miscellaneous revenues. Expenditures will not be charged against the public safety tax revenues until said 36.8 percent General Fund revenues have first been used or encumbered.

In 2015 and 2016, city staff met with representatives of the police and fire unions to resolve the interpretation of the term “taxes” within Ordinance 2575.

Per the 2016 memorandum of understanding among the City of Edmond, the Fraternal Order of Police Lodge 136 and the International Association of Fire Fighters Local 2359, the parties agreed to interpret “taxes” as sales tax, use tax, franchise tax, liquor tax, lodging tax, alcohol tax, cigarette tax, and gas and vehicle tax, effective with the passage of the 2016-2017 budget. That means EFD receives funding equal to 30 percent of each of these tax revenues, while EPD receives a 36.8 percent total.

Prior to the 2016 agreement, the alcohol, cigarette, and gas and vehicle tax were not subject to those funding thresholds.

Brett Sharp, director of the master of public administration program at the University of Central Oklahoma, questioned how baseline funding for each department could have been enacted in 2000 since that section of the proposal was not included on ballots.

“The real question is: Why did it not appear on the ballot? Once that language was not totally on the ballot, how do you implement it?” Sharp said. “Sometimes, they try to get very specific so that it will be implemented the way that it’s intended. This seems to be more information omitted and not (using) confusing language on purpose.”

‘That was not the intent’

Leonard Martin, who served as Edmond’s city manager from 1994 to 2001, said the mandated general fund percentages were negotiated with the police and fire unions prior to the 2000 vote. The percentages — 30 percent for EFD and 36.8 percent for EPD funding — represented what the departments were already receiving in the 1999-2000 fiscal year.

“We looked at what are you getting today as a percent,” Martin said. “If the voters approve the two sales taxes, you will get all of that additional sales tax, and you will continue to get the same percent of the general fund (…) into perpetuity.”

Asked why the 2000 ballot title did not explain those permanent baseline funding percentages to voters, Martin said he was unsure.

“It was probably hard for the citizens to get into that percentage maybe? I don’t know,” Martin said. “It could have been a drafting oversight — that we knew what the intent was and the spirit of it, but it didn’t get fully vetted out in that ballot initiative.”

Transferring additional general fund monies to EPD and EFD based on all future sales tax revenue decisions, like inclusion of the new marijuana tax, was not the goal of the ordinance, Martin said.

“That was never the intent back when we passed this,” Martin said. “I’ll just say that point blank. That was not the intent.”

Instead, Martin said that language was intended to prevent the public safety departments from vying with other city departments for general fund dollars in the future.

“It got them out of having to compete so hard for that general fund money, because the general fund was going to be allocated to them based on whatever that percentage was each budget year,” Martin said.

Steve Murdock, who served as Edmond’s city attorney from 1987 until his January retirement, said in December that he remembers no confusion about the ballot question’s intent or its title.

“We always try to provide information and background, and a person could find that information if they wanted it,” Murdock said. “It wasn’t a subject of significant debate, that I recall.”

On Martin’s assertion that the language describing EPD and EFD’s baseline funding thresholds could have been omitted from the ballot by “oversight,” Murdock disagreed.

“I don’t think it was an oversight at all. We fully complied with the law with everything we did regarding that,” Murdock said. “Maybe from his perspective, we didn’t want to get into the weeds. I understand that, but that doesn’t mean that the ballot title or anything related to it was not in compliance with the law.”

Martin noted that negotiating with Edmond’s police and fire unions had been difficult at the time.

“This took some time for me to negotiate with the unions. By the time I left, I had a decent relationship, but, boy, let me tell you, it was ongoing warfare,” Martin said. “Out of the seven years I was there, at least for four years, (I was) fighting the unions who were trying to grab as much as they could.”

Chris Cook, president of Edmond’s Fraternal Order of Police lodge, said the unions have never heard any issue from city leaders since the 2000 ordinance passed.

“This was agreed to, overall, by city leaders,” Cook said. “We haven’t heard from anyone, we don’t know of anybody that is upset (with the funding formula).”

Cook added that Edmond’s public safety unions have been open to agreements that give the city more leeway to collect revenue exempt from the police and fire funding formula, such as the Gracelawn Cemetery MOU and agreement not to receive increased lodging tax money.

“We worked with the city, and we agreed to not take any of that since the city needed the money,” Cook said. “We see the positives of growing Edmond. I think we’ve been very good when it comes to working with the city.”

According to a revenue and expense optimization study from Willdan Financial Services presented to the Edmond City Council in November 2022, Edmond’s public safety expenses per capita stand higher than larger Oklahoma cities. According to the report, Edmond’s public safety expenses equaled $608 per capita over a three-year average, while public safety departments in cities like Broken Arrow and Norman receive $491 and $425 per capita, respectively.

Scot Rigby, Edmond city manager, said the city’s emphasis on public safety has long been a large draw for residents.

“Yeah, we fund public safety probably the highest in the state on a per-capita basis,” Rigby said. “But you see the results: Low crime, high response rate. I think that’s a big reason why people move to Edmond is the safety of the community, as well as the quality of life. Oftentimes we talk about the schools, but they all work together.”

Rigby said there has not been discussion among city leaders related to a potential change in the funding thresholds outlined in Ordinance 2575. Whether it faces future changes or not, Rigby said, the need for robust public safety departments will always remain.

“It’s not unusual that your public safety departments are your highest cost setters of any city,” Rigby said. “I’m always open to discussion, but there hasn’t been any recent discussion about changing the way our funding formula (works) on police and fire.”

‘We’ve got money issues’

The odd ordinance became a topic of discussion among city leaders during the Edmond City Council’s strategic planning session Nov. 7, 2023. Earlier that year, a separate ordinance dedicated the city’s medical marijuana sales tax revenues to community programs and projects “that positively impact the health and well-being of youth and adults.”

Kathy Panas, Edmond’s finance director, said the city expects to collect “a little under” $500,000 in medical marijuana sales tax revenue annually. However, Panas said Ordinance 2575 requires EPD and EFD to be given their dedicated percentages of that tax revenue via transfers out of unallocated General Fund dollars.

“We will still match police and fire their share of that sales tax,” Panas said. “The effect on the General Fund is probably around $800,000, because we’ll still fund police and fire, and then we’ll move that $500,000 out for the earmarked portion.”

Christin Mugg, Ward 3 councilwoman, asked Panas to clarify.

“So, the marijuana tax is bringing in $800,000?” Mugg asked.

Panas explained that EPD and EFD must receive an amount equal to “about two-thirds” of the medical marijuana tax revenue.

“It’s bringing in $500,000,” Panas said. “But, per our negotiated agreement with our police and fire unions, they do get a certain percentage of all of our sales tax.”

For example, the city received $711,437 in revenue from its original 4 percent lodging tax in Fiscal Year 2022. Because of the 2000 ordinance, EPD receives general fund transfer amounts equal to 36.8 percent of those revenues, and EFD receives general fund transfer amounts equal to 30 percent. This means the departments collectively received about $475,240 from a general fund transfer in Fiscal Year 2022 based on the 4 percent lodging tax revenue collection.

Mugg questioned the funding mechanism because it redirects dollars from the general fund, which also funds parks, streets and other departments.

“I understand the resolution, but it just seems that we’re taking more money out of the general fund for other projects,” Mugg said. “I mean, we’ve got money issues.”