Think about the last time you bought something using cash. It might have been this morning or yesterday or maybe even days, weeks or months ago. It’s not a given, however, that you paid cash anytime recently, because we have evolved into a purchase-on-credit society.

This past year taught me more than I ever intended to learn about credit and the pros and cons that go with it. Whether it was finding out that some employers use credit scores to determine employment or that it is common for insurance companies to assume bad credit leads to poor driving, it has been a somewhat disheartening year of discovery.

I’ll be the first to admit I have made some mistakes through the years when it comes to my finances. I could have a less-than-perfect credit report on my own. They weren’t teaching financial literacy when I was going to school, and I haven’t always made the right choices when it comes to being financially responsible. My poor choices, however, seem minimal in comparison to the consumer-crippling decisions made by businesses and the elected officials who allow them to get away with it.

Businesses, credit bureaus too cozy

Earlier this year, two of the three major credit bureaus were fined more than $23 million for misrepresenting credit scores when reporting to lenders and businesses. The Consumer Financial Protection Bureau discovered during its investigation that reports provided to consumers were different than those provided to companies requesting their score.

For those of you who aren’t sure how it works, there are three major credit bureaus — Transunion, Equifax and Experian — that produce a credit score based on data provided by companies you do business with as a consumer. This may be buying a car or a house or even a pack of gum. If you default on your payment in any way, it can be a negative. If you buy on credit and then pay it off as scheduled, there is even a chance that will help your score. Keep in mind, if you allow someone to look at your credit score, that can hurt your score as well.

It wasn’t shocking that there might be some shady conduct going on when it comes to credit reporting. The very nature of what credit bureaus do as an industry lends itself to potentially negative conduct. When it comes to money and numbers, we all know there is potential for corruption or at least misleading behavior. It’s too easy, and the laws regulating this industry have just recently started to bring a limited benefit to the consumers. Sure, there have been consumer-friendly regulations in the past, but it seems as if the regulatory pendulum has swung back the other way in the past several decades.

Personally, I have had some concerns about the cozy relationship between credit bureaus and businesses. But probably not for the reasons you might think.

Insurance rates tied to credit history

In recent years, I heard rumors that insurance rates were often linked to credit history. I went through a training class to become a certified consultant last year and discovered this was absolutely true. It wasn’t a rumor — it was common knowledge. Apparently someone decided there needed to be a link between people with bad credit and bad driving, and then it just became a reality. It’s embarrassing enough that someone actually attempted to promote this as an actual reality, but it was over-the-top shocking that insurance companies actually operate with this mindset. Even if the numbers seem to indicate it, that would have to be an aberration. Reality tells us it isn’t true.

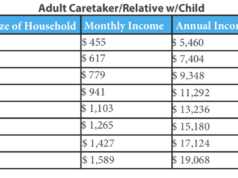

If you want to tell me that people with a poor credit history might also be someone who wouldn’t be able to afford insurance and might have a suspended license, I could buy that. But the solution here isn’t to raise insurance rates on people who already struggle to pay their bills. Clearly, the numbers will also tell you there is a segment of people who aren’t getting paid for the work they perform. Too many people are needing to work two, three and sometimes four jobs just to keep up with the bills they have.

(Those people who are able to get four jobs just to keep their bills paid are actually modern-day heroes. And not just because of their work ethic.)

Companies look at credit history when hiring

Another surprising thing I’ve learned in the past few years is that employers actually use your credit score to help determine whether to employ you. So, if you have always been underpaid by companies, your chances of getting that lucky break are minimal at best. That dream-job company is going to see you struggled to pay your bills for years, and they aren’t going to care that it was because you were routinely low-balled on your paycheck. It’s yet another vicious cycle that works against those who start out in lower socioeconomic conditions.

Companies need to use some common sense. How I spend my money once I get my paycheck is my business. As long as it is legal, an employer shouldn’t get to monitor my spending. Especially considering how sensitive businesses are when it comes to providing their financial information, it is shocking that employers are even allowed to look at our credit scores as a condition of employment.

A more realistic approach needed

Now that we know that the credit bureaus haven’t exactly been operating within the rules, it is time that we take a more employee-friendly approach to disclosing financial information. If a company wants to provide financial data to the public, then they can ask for employees to disclose the same when they apply for a job with that company. Otherwise, it is none of their business, and they can go back to hiring employees on their merits rather than their socioeconomic status.

People generally don’t want to purchase on credit, but the promise of a better tomorrow makes them feel like they might be able to pay off that credit card soon. Instead, life gets in the way or at least doesn’t work out as they had hoped. Businesses shouldn’t kick them around even more once they realize that is in fact what happened to them. It’s time to take a more realistic approach to financial issues like credit history and find a solution that helps people rather than send them further into debt.