The 2017 Oklahoma Legislature has taken no bigger swing at a “grand bargain” than the vote that will be coming Wednesday in the House of Representatives — a doubling of the gross production tax rate on new wells, plus consumption taxes that will raise hundreds of millions of dollars in coming years.

Passing such a measure would allow for a $3,000 teacher raise and a $1,000 state employee raise, if all goes to purported plan.

But hitting such a home run for the state’s struggling coffers will require 76 “aye” votes in the House, a fastball that Speaker Charles McCall has been unable to square up during his first year batting leadoff.

To McCall’s detriment have been criticisms that the prominent Atoka banker has protected oil and gas interests from public groundswell for a higher GPT rate. McCall has also been criticized within his caucus for not “leading” the House to a revenue solution over months of negotiations, and he allowed his team to forfeit in committee when they had a chance to pass this same bill to the full House on Oct. 27. (That required the help of a majority of Democrats voting no, of course.)

But if they give in to public pressure about pending service cuts this week, McCall and his leadership team will toss the Senate’s crisp, new ball into the air and swing for the fences, trying to gap one between a speedy left fielder — Democrats who have sought a 1-percent-higher raise in GPT — and a crafty right fielder — oil-loyal Republicans who employ dubious rhetoric to grandstand against government while being elected to oversee it.

In such a baseball analogy, centerfield has been unoccupied since the spring, but a myriad of factors have prevented the bipartisan line-drive up the middle that would benefit average Oklahomans and communities.

Call it partisan politics or call it the most bizarre recent session veteran Capitol insiders can recall, the label hardly matters.

If the public gets its way, representatives will take the floor vote Wednesday by which Oklahomans will judge their annual performance.

If you remotely have an opinion about Oklahoma’s health care, education, taxes or petroleum industry, tune in for the play by play whenever a vote might be called. Also, this would be the time to contact your state representative, if telling someone how to hold the bat is your thing.

Unlike the average ballplayer, legislators truly appreciate respectful feedback from the public.

What is in the bill

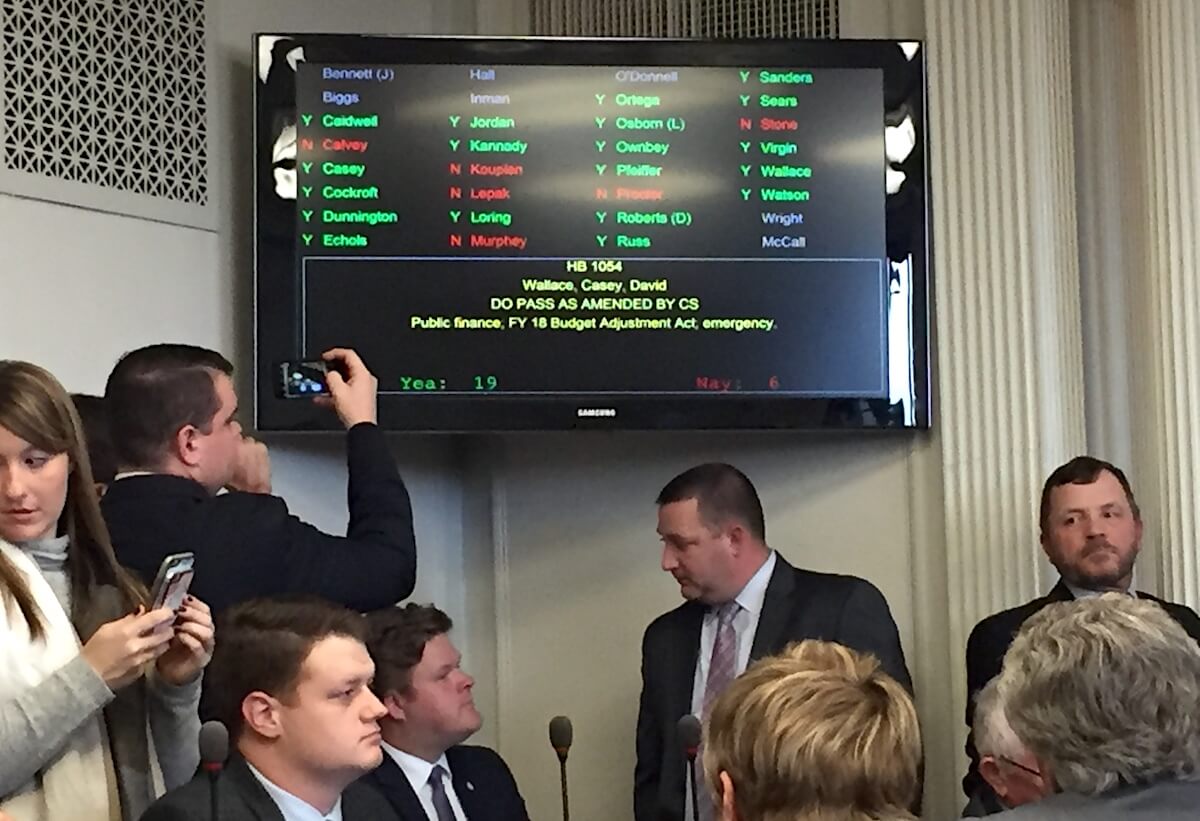

House Majority Floor Leader Jon Echols (R-OKC) said in a tweet minutes before the publication of this post that the “bill will be heard on the floor.” The proposal — HB 1054, instead of the Senate’s amended version — passed a House Joint Committee on Appropriations and Budget on Tuesday afternoon by a 19-6 vote.

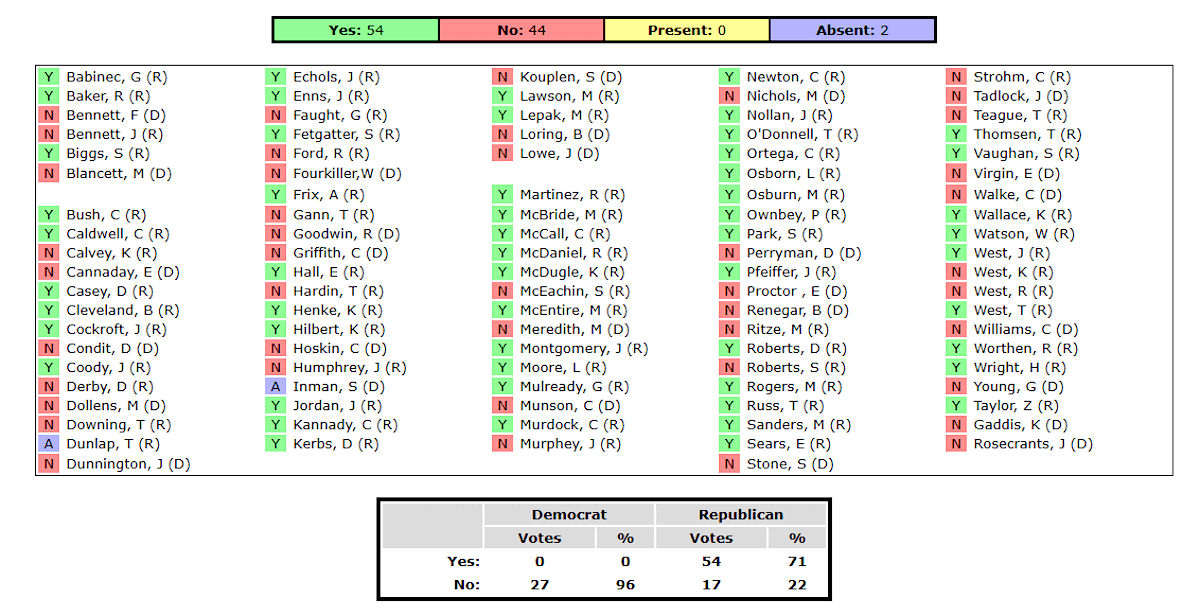

While you search for your state representative, we have crafted a summary of what lawmakers would be voting on in what the Senate has dubbed the “A+” plan. We also have provided a breakdown of how House members voted on an earlier version of the measure Oct. 25 that did not include gross production tax changes.

The revenue items in the new proposal include the following, which Senate leaders said will raise $132 million for this fiscal year’s budget hole and $426 million for the next:

- a $1.50 tax on cigarettes

- a $0.06 increase on the gas and diesel tax

- a change to the taxation of low-point beer

- a new tax on chewing tobacco, smokeless tobacco and snuff

- a change in GPT incentive rate from 2 percent to 4 percent

- tax rate modification on “little cigars”

- modifications to tax stamp rules on cigarettes

While those tax increases range from little cigars to big oil, they represent several proposals with storied political histories.

Tobacco companies have watched Oklahoma Democrats thwart the $1.50 cigarette tax proposal for two years owing to Oklahoma Republicans’ opposition to expanding Medicaid or — thus far — raising the gross production tax.

The state’s effective gross production tax rates have risen slowly in the past three years, and the Oklahoma oil and gas industry has faced its least friendly political climate in more than a decade, partially owing to low commodity prices, partially owing to muddy messaging and partially owing to the “seismicity issue.”

Gas and diesel taxes have not been raised in Oklahoma since 1987 despite the state’s convenient location as the intersection of three major U.S. highways. Lawmakers have claimed up to 40 percent of Oklahoma highway traffic is simply passing through, meaning Texans and other travelers buy a sizable chunk of all fuel sold in the state. While Democrats have effectively labeled the $0.06 fuel tax as “regressive,” Republicans have been unable to articulate compelling rebuttals such as, “a 16-gallon tank would cost only $0.96 more to fill up,” or, “Halliburton trucks buy a lot more fuel than the average person.”

Republicans and Democrats face decisions

Since this “grand bargain” will need 76 of 99 House votes to pass, every state representative’s vote will matter if GOP leadership decides to put it on the board. Chief among those decisions will be one from the longtime face of House Democrats: Rep. Scott Inman (D-Del City).

Inman ended his gubernatorial campaign Oct. 25 after a heated discussion with his wife at the Capitol. He also announced he would be resigning from his seat in the Legislature come January, and he walked the same day’s revenue vote that did not feature GPT.

With Inman unseen at the Capitol since the Senate announced its bipartisan agreement to include 4 percent GPT the next day, onlookers have wondered whether he will attend if GOP leaders put it on the board. If Inman does ensure that residents of his hometown have a voice on the revenue bill, he will be picking between two final chapters in a fascinating book about his political legacy.

Would he be remembered for casting a vote that helped pass a teacher pay plan by doubling the gross production tax on oil companies? Or would he vote no and return to his district, knowing that he forced the hand of his GOP counterparts into cutting more state services for the vulnerable?

Beyond Inman, the 27 other House Democrats must make many of the same internal calculations: Pass a plan with undeniable benefits but undeniable issues, or vote no and find a way to justify critical agency cuts in their consciences — and their districts — all winter.

House Republicans are largely in the same boat, except that more than a dozen members of their caucus are so staunchly conservative that Capitol press quip they would not vote to raise the tax rate on murderers.

For those Republicans with an appetite for new revenue, the upcoming decision comes with more sour sauce for the GOP palette than other 2017 tax votes. This time, Republican lawmakers will have to determine whether higher taxes on their typically loyal oil and gas backers is a deal-breaker. They, too, will have to choose between “letting it burn” or looking oil industry leaders in the eye and saying, “We had to do this for the good of the state.”

Vote total from the non-GPT revenue bill

Provided by the bill-tracking service LegisOK, the screenshot above shows how House members voted on the Oct. 25 revenue bill that did not include a GPT hike. Since that vote, Chickasha Rep. Scott Biggs has resigned, leaving only 99 seated members in the House.

How many Republicans would remain in the “Yes” column for the new bill is yet to be seen, as is how many Democrats would light up the board green in favor of their first chance to raise the GPT incentive rate.

If pro-deal Republicans hold firm and about 20 Democrats vote “aye,” legislative leaders might just be able to whip enough votes to reach the 76 needed for passage, assuming they truly want the deal to succeed.

Or, if momentum does not build toward the magic number with the vote open, a slew of members could vote “nay” if they believe the ship is going down.

‘Put it on the board’

For weeks, freshman Rep. Roger Ford (R-Midwest City) has wanted a vote on the grand bargain measure featuring GPT.

“I think it’s time to put it on the board. The Senate has acted. I think we should have already acted on this,” Ford said Tuesday. “Just an up-or-down vote. It either makes it or it doesn’t, but from the emails and messages I’m getting from constituents and across the state, it’s something that people want to happen.”

Ford described what he is hearing from the people he represents.

“We’re obviously in crisis, there’s no question about that. I don’t think there’s anybody who wants to see all these services fail,” Ford said. “How we get there is a big difference of opinion among representatives and senators, but something has got to happen. We just cannot continue on the path we’re on. So it’s time for an up-and-down vote.”

Democratic Rep. Jason Dunnington (D-OKC) agreed.

“I absolutely think that Oklahoma citizens deserve having a vote on this measure,” said Dunnington, who was the only Democrat to vote for the proposal in committee Oct. 27. “This is what we get elected to do, and at this point we need to be moving forward. Forward is defined a lot of different ways by different people, but this is certainly moving forward, and we need to have a vote.”

(Update: This post was updated at 3:25 p.m. Tuesday, Nov. 7, to note the bill passed House JCAB 19-6.)