(Update: On Jan. 17, 2024, the Oklahoma Supreme Court held oral arguments in the Stroble v. Oklahoma Tax Commission case. The following article remains in its original form.)

Implications of the U.S. Supreme Court’s 2020 landmark ruling in McGirt v. Oklahoma are still in dispute three years later as the Oklahoma Supreme Court prepares to weigh arguments in the Stroble v. Oklahoma Tax Commission case, which asks whether tribal citizens who live within reservation boundaries and work for tribally controlled entities are exempt from state income tax.

While the state Supreme Court’s consideration lingers, recent drama surrounding Oklahoma Gov. Kevin Stitt’s tobacco compact extension veto, which was overridden by the Legislature in July, sparked comments on the Stroble case from Stitt, legislators and tribal leaders.

“The Stroble case is something everybody should be aware of,” Stitt said on the final day of this year’s regular session.

If the Oklahoma Tax Commission prevails, it will bolster arguments that the eight reservations affirmed through the McGirt decision are limited in application to only criminal law. If Stroble prevails, it would be the second major affirmation that the reservations also exist for purposes of civil law, and it could exempt tens of thousands of additional tribal citizens from state income tax jurisdiction.

That would decrease state revenues by tens of millions of dollars, and it could spur the creation of state-tribal income tax compacts to avoid such an impact. Or it could convince the Oklahoma Legislature to eliminate income tax completely, something some Republican leaders have already championed.

‘Indian Country now is different’

In December 2020, five months after the McGirt decision, Alicia Stroble filed delinquent Oklahoma tax returns for 2017, 2018 and 2019. As an enrolled citizen of the Muscogee (Creek) Nation who lived well within the tribe’s reservation boundaries and worked for the tribe during those three years, Stroble claimed exempt tribal income on all three returns.

To claim the tribal income exemption, citizens of federally recognized tribes must meet two prerequisites, according to Section 710:50-15-2(b)(1) of the Oklahoma Administrative Code, which reads:

The income of an enrolled member of a federally recognized Indian tribe shall be exempt from Oklahoma individual income tax when (…) the member is living within “Indian Country” under the jurisdiction of the tribe to which the member belongs; and, the income is earned from sources within “Indian Country” under the jurisdiction of the tribe to which the member belongs (…).

After the Oklahoma Tax Commission’s audit services division completed an audit of Stroble’s delinquent tax returns, she received three letters in February 2021 denying her tribal income exemptions for 2017, 2018 and 2019 and asking for back tax payments totaling $7,535.

In denying Stroble’s claimed exemption, the OTC relied on the Stitt administration’s argument since July 2020: that the McGirt decision only affirmed the Muscogee Nation as a federally prescribed “Indian Country” reservation for the purposes of criminal jurisdiction, not civil matters.

Under 18 U.S.C 1151, “Indian Country” is a specific designation for three types of land:

- historic land allotments;

- land held in trust by the federal government for the benefit of a tribe; and

- land within a tribe’s reservation.

With limited exceptions created by Congress, state laws generally have no or little application to tribal citizens and tribal governments on Indian Country land.

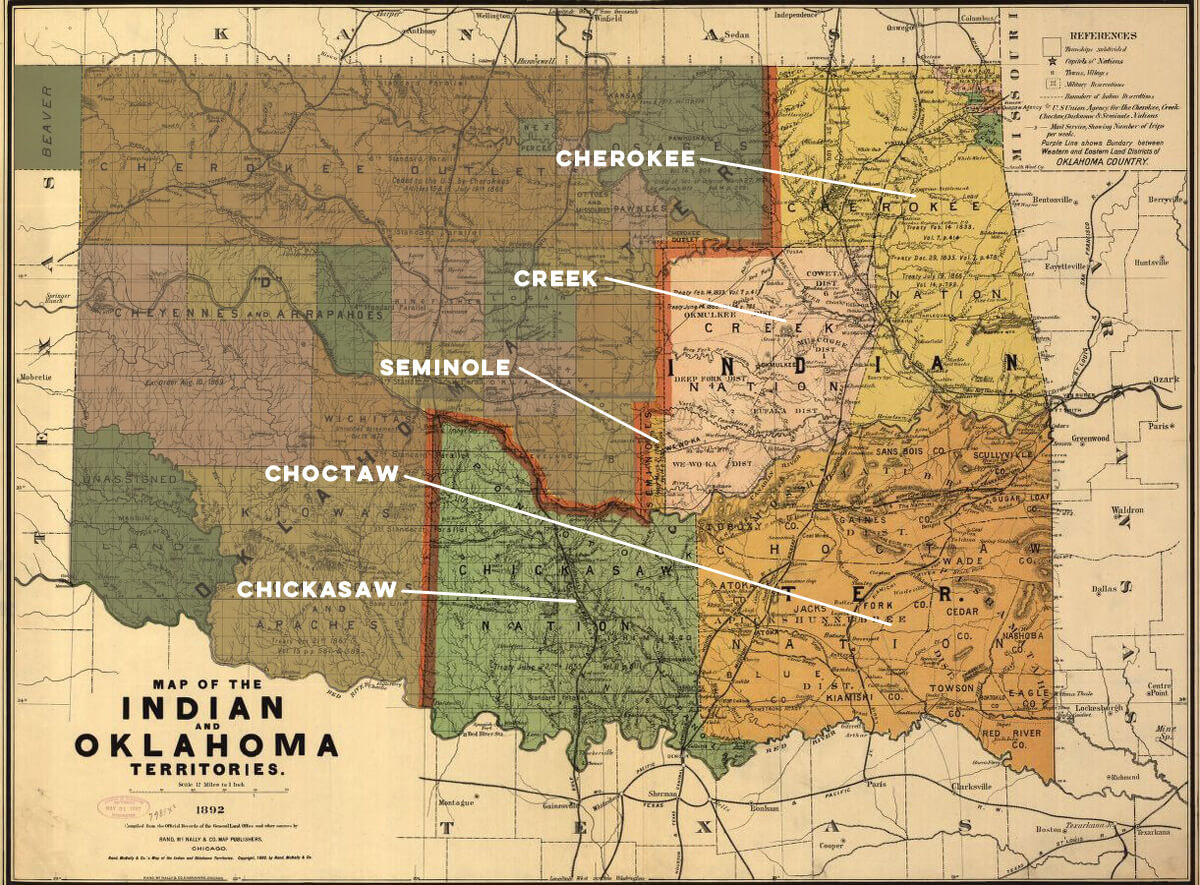

Following the 2020 McGirt ruling, thousands of tribal citizens in eastern Oklahoma have filed for the tribal income exemption with the OTC. In short, those tribal citizens have argued the McGirt decision means that Muscogee, Cherokee, Chickasaw, Choctaw, Seminole, Quapaw, Ottawa and Peoria nations qualify as Indian Country reservations for civil matters, such as taxation. The state of Oklahoma has maintained that the nations are only Indian Country reservations for purposes of the federal Major Crimes Act.

To that end, the OTC contended Stroble did not qualify for the tribal income exemption as she did not live on Indian Country land. Stroble protested the OTC’s denial of her exemption application.

Dig deeper:

Find files on

Turtle Talk

The case has made it all the way to the Oklahoma Supreme Court, and Michael Parks, Stroble’s attorney, filed a motion for the court to hear oral arguments in February. The Muscogee (Creek), Seminole, Cherokee, Chickasaw and Choctaw nations have all filed amici briefs in support of Stroble, arguing that their reservations do exist for civil law purposes.

Stitt argues otherwise, saying in a July press conference that the tribes “want to have complete control over their reservation land.”

“In the McGirt ruling, it said that the [Muscogee Nation] reservation was still in existence for the Major Crimes Act only, and now you’re seeing the tribal governments argue that the reservations exist for all purposes,” Stitt said. “Everything should be fair. We can’t have a system where we have some people that do it one way and everybody else does it another way.”

In the Muscogee and Seminole nations’ joint amici brief, the Muscogee Nation said it is not seeking to “unilaterally assert sovereignty over any lands.”

“This case simply does not involve a unilateral effort by the nation to create tax immunity, much less create Indian Country,” the brief said. “Oklahoma itself has prescribed an exemption for tribal citizens who live and work in Indian Country, and nothing could be less unilateral than a (Muscogee) Creek citizen simply claiming this state law exemption.”

Chickasaw Nation Gov. Bill Anoatubby said in an interview that he thinks many more people qualify for the tribal income tax exemption than have taken advantage of it.

“If you look at the Oklahoma income tax form, there’s a line on there where you can deduct any income you’ve had if you lived and worked in Indian Country,” Anoatubby said. “It’s there. It’s been there for years, but it hasn’t necessarily been utilized because there haven’t been that many people that truly qualified. Before (…), it had to be trust land, but Indian Country now is different. I think it’s just a matter of working our way through this. So many people qualify, and so many people don’t.”

Choctaw Nation Chief Gary Batton suggested an income tax compact between the state and the tribes could come into play depending on how the Stroble case is ultimately adjudicated.

“As a sovereign nation, our tribal members, I do not believe that they should be taxed,” Batton said. “However, we are all Oklahomans, and we do need to pay our fair share. I think there’s a compact on taxation that should come into place at some point in time in the future.”

Asked about Batton’s idea for a state-tribal compact on income taxation, Anoatubby did not express support or opposition.

House Speaker Charles McCall said in a July 31 press conference that, whatever happens in the Stroble case, Oklahomans should “be treated all the same” on matters of taxation.

“I certainly feel like we’re all Oklahomans, whether we’re tribal or non-tribal members, and there are some things that we should all agree to do,” said McCall (R-Atoka). “I think taxation is something that should be uniform in the state of Oklahoma. If one segment is going to move to no personal income tax in the state, then I plan to take all segments toward no personal income tax in the state. We need to be treated all the same.”

The state of Oklahoma collected about $4.8 billion in individual income taxes for Fiscal Year 2022, which was close to 29 percent of the state’s total revenue collections.

Debating the definition of ‘Indian Country’

In May 2021, Stroble’s protest with the Oklahoma Tax Commission was brought before Administrative Law Judge Ernest Short.

In his brief, Parks argued that Stroble qualified for the tribal income exemption, citing 18 U.S.C. 1151, the definition of “Indian country” as found within federal criminal code. Parks argued the federal definition of “Indian Country” covers individually owned homes within the jurisdictional boundaries of tribal reservations.

Nearly a year later, Short issued his findings, conclusions and recommendation to the Oklahoma Tax Commission’s audit services division. Short recommended Stroble’s exemption be granted, concluding the Supreme Court has consistently applied the federal definition of “Indian Country” to civil matters, despite being defined within federal criminal code.

“Although Section 1151 by its terms defines Indian Country for purposes of determining federal criminal jurisdiction, the classification generally applies to questions of both civil and criminal jurisdiction,” Short quoted from California v. Cabazon Band of Mission Indians, a 1987 U.S. Supreme Court case. “More specifically, the court in Sac and Fox Nation, 508 U.S. at 123, cites to 18 U.S.C. 1151 for the definition of ‘Indian Country’ when determining the residence requirement of a tribal member claiming exemption from Oklahoma’s state income tax. By its express terms, 18 U.S.C. 1151(a) includes within the definition of Indian Country all lands within the congressionally prescribed boundaries of a reservation, including private fee lands.”

In April 2022, the OTC’s audit services division filed for an en banc hearing before the Oklahoma Tax Commission’s Office of Commissioners, citing “errors” in Short’s conclusions. The hearing was held nearly four months later, and in October 2022, the OTC released a “precedential decision” in the case, denying Stroble’s exemption.

“A review of the record makes it abundantly clear that [Short’s] analysis and recommendation in the FCRs hinges entirely upon an unauthorized expansion of the recent decision of the U.S. Supreme Court in McGirt v. Oklahoma (…) to state taxation matters,” the decision said. “The administrative law judge’s unilateral conclusion that the McGirt decision has application to the taxation protest before the OTC is without basis and completely discounts the Supreme Court’s express limitation of McGirt to the [Major Crimes Act].”

Quoting from the McGirt decision, the OTC held that the U.S. Supreme Court’s ruling on the Muscogee Reservation’s status was limited solely to criminal matters and had no bearing on civil cases.

“Finally, the state worries that our decision will have significant consequences for civil and regulatory law,” the McGirt decision said. “The only question before us, however, concerns the statutory definition of ‘Indian Country’ as it applies in federal criminal law under the [Major Crimes Act], and often nothing requires other civil statutes or regulations to rely on definitions found in the criminal law.”

OTC denies report implying McGirt’s civil applications

In an interview, Muscogee (Creek) Nation Chief David Hill said the Oklahoma Tax Commission and the tribes differ in their interpretations of “Indian Country,” and he mentioned a 2020 OTC report — which the OTC now denies — inferring the McGirt decision actively applies to state taxation matters.

The report signed by former OTC executive director Jay Doyle suggested the state could see a $72 million impact on income tax collections and a $131 million impact on sales and use tax collections if the reservations in eastern Oklahoma apply for civil law purposes.

“Although McGirt arose from a criminal proceeding, the implications of the decision extend to many other areas of Oklahoma law, including the taxes and fees administered by the Oklahoma Tax Commission,” the report said. “The decision changes the geographical area in which the OTC has jurisdiction to levy and enforce the state’s taxes, but it does not directly affect the procedures already in place to administer those taxes. The OTC anticipates the primary fiscal impact of McGirt will be reflected in reduced collections for individual income tax and sales/use tax, due to increased numbers of Creek Nation tribal members eligible to earn exempt income and make purchases exempt from sales/use tax.”

In its Stroble analysis, however, the Oklahoma Tax Commission actively denied the report’s validity, saying it was neither ordered nor signed by the OTC’s Office of Commissioners.

“The commissioners were not aware the report was being prepared, and the commissioners did not review, issue or approve the report prior to its publication and distribution,” the OTC’s decision in Stroble’s case read. “A formal position taken by the commission would be set forth in a commission order, signed by the commissioners, and to date no such order has been issued.”

The same day the OTC’s decision was handed down, Stroble appealed to the Oklahoma Supreme Court. Michael Parks, Stroble’s attorney, filed his motion for oral arguments in February. No new actions have been taken in the case since May 17.