What a difference a vowel can make.

As 2017’s Oklahoma legislative session nears its conclusion and lawmakers decide major energy industry policy questions, the vociferous lobbying features two groups that share history, membership and three-fourths of their acronyms: the Oklahoma Independent Petroleum Association and the Oklahoma Energy Producers Alliance.

But on the year’s two biggest oil and gas issues — an expansion of lateral drilling opportunities and potential rollback of a gross production tax break — OIPA and OEPA hold dramatically different positions.

While the OIPA is far older and has considerable influence, the OEPA’s board of directors contains five former OIPA chairmen who believe their former organization has begun to ignore the best interests of vertical-well producers and the state of Oklahoma as a whole.

“We’ve been called a splinter group. You know, the Founders (of this country) were a splinter group, so I think we’re in pretty good company,” said OEPA co-chairman Mike Cantrell. “The five of us (…) we’re all industry leaders. All these guys have had 30 to 35 years experience in the industry and at the Capitol.”

Cantrell invited media to the OEPA’s board meeting Wednesday at the Faculty House just south of the Capitol. He opened remarks with an exposition on the OIPA.

“They rely on lobbyists, and that’s OK. Between them and the other big associations, they have over 30 lobbyists,” Cantrell said. “We’ve got one, and that’s OK because each one of us, we’re very familiar with the process, and for the last two years, us and others have gone to the Capitol and stopped a Speaker Pro Tempore bill two years in a row, and we’ve done it one member at a time.”

This year, Cantrell and his cohorts are trying to stop or modify another leadership bill — SB 867 (embedded below). It would double the allowed lateral spacing for horizontally drilled oil or gas wells and establish rules for the Oklahoma Corporation Commission to monitor “long lateral” drilling applications.

But OIPA vice president of government affairs Tim Wigley said the “very complex” bill is critical for the future of oil and gas production in Oklahoma.

“The future of this industry and the game-changer in the last decade has been horizontal drilling,” Wigley said. “The ability to do that at longer lengths is going to be good for the state, good for the industry and create revenue for the state.”

Wigley said OIPA is working with the Oklahoma Oil and Gas Association (OKOGA) to guide SB 867 through its final legislative hurdles — a House Joint Committee on Appropriations and Budget hearing, then House and Senate floor votes — before the theoretical sine die of May 26.

“We put an incredible amount of time and effort into coming up with the language in this legislation,” Wigley said. “We feel like we’ve got a pretty good shot at getting it across the line, but there’s a lot of work left to do.”

‘A lot of problems’

Cantrell, former Tulsa Mayor Dewey Bartlett and other leaders of OEPA also feel they have work left to do. Much like OIPA, they are going legislator by legislator in an attempt to persuade lawmakers to believe their side of the issue.

“We’re here to try to protect relative rights. The way the bill is written now, it doesn’t seem to do that. It can be adjusted, but maybe not before it becomes law,” said Ray Potts, who entered the oil and gas industry in 1959. “We have lease boundaries that you can’t get closer than roughly 600 feet (to another well), and now we’d have horizontal boundaries if we put this horizontal law into effect.”

Potts and OEPA members said some horizontal drilling operations have caused severe damage to existing vertical wells.

“So you’re penalized if you crowd a man’s lease drilling vertically, how about if you drill horizontally? Are you going to be penalized?” Potts asked. “There’s a lot of problems associated with this. The Legislature has a heck of a job, and I hope they can come up with something that is fair and equitable for everybody.”

Pete Brown, co-owner of Brown & Borelli, Inc. in Kingfisher, said more than a dozen of his vertical wells have been damaged one way or another by horizontal drilling. He said each well is worth between $100,000 and $150,000. The OEPA would like to see SB 867 include some sort of “vertical damage protection act” similar to surface protections already in law.

But Wigley said OIPA does not believe that’s necessary.

“What they’re looking for is total protection in a statute,” he said. “But many of those protections are already available at the Corporation Commission, and that’s why we have the stance that we have on it.”

OIPA and OEPA also have opposing positions on what is called forced pooling, although Cantrell said OEPA has no illusions of getting rid of that process this year.

Poor education funding ‘shameful’

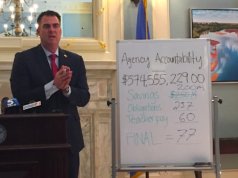

The other primary area where the organizations disagree concerns the state’s gross production tax on oil or gas extracted from the ground.

OIPA has been fighting to keep the first 36 months of new wells taxed at an incentive rate of 2 percent. Meanwhile, OEPA would like to see the incentive rate removed entirely or at least modified.

The state’s standard rate is 7 percent.

“[Companies] are not going to leave the state based on a 7 percent gross production tax, I can assure you,” Potts said Wednesday.

He, Bartlett, Cantrell and Brown spoke of why they support eliminating a tax incentive within their own industry.

“We’re all Oklahoma producers,” Brown said. “We live in Oklahoma. A lot of these other producers are out of Houston or somewhere else. They don’t have a stake in Oklahoma the way we do. The state needs money. When we’re the worst state in the nation for supporting our schools, that’s shameful.”

Wigley discussed small-operation members of his organization whose tight margins would be eliminated by changes to GPT rates. He noted that OIPA’s 2,500 members are mostly small producers, with one exception being Continental Resources. He noted that OKOGA represents Devon, Chesapeake, British Petroleum and other massive operators.

“It’s not unusual in the oil and gas world that one group represents larger producers and one group represents smaller producers,” Wigley said.

RELATED

Lawmaker on dustup with oil lobbyist: ‘They’re not going to bully us’ by William W. Savage III

He believes incentivizing new well investment from outside Oklahoma is too important to risk changing the production tax structure.

“Oklahoma is currently the No. 1 target for outside investment of oil and gas production,” said Wigley, who moved to Oklahoma after working for a similar organization in Colorado. “I don’t understand why, if you’re the No. 1 target for new investment, why you’d want to go take a chance and mess with that. We’re not in this situation in Oklahoma because the oil and gas industry doesn’t pay enough taxes.”

But the OEPA was borne out of disagreement, particularly on horizontal drilling regulations and additionally on tax structures. Cantrell said OIPA had made “a cultural change.”

“OIPA put the interests of themselves ahead of — and we were there when it happened — ahead of the state’s interests,” Cantrell said. “A 2 percent gross production tax rate?”

Despite Bartlett’s father and grandfather having helped found the OIPA, the former Tulsa mayor is one of the OEPA’s strongest voices. He, Brown and Potts still serve on the OIPA’s executive committee, but they have a different message.

“There’s an opportunity in front of us right now,” Bartlett said. “The gross production tax needs to be equalized among all of us to help our state. The state of Oklahoma has been extremely good to each and every one of us in this room. To all of our families, employees, etc.

“We’ve seen it for the last four years how, in the state of Oklahoma, the budget has been coming up short by hundreds of millions of dollars every year. Now they’re at a point where the state of Oklahoma is in jeopardy. The educational system, the highway system, the correctional system, public safety, the park system. Everything. They are all in jeopardy of being able to fulfill their basic obligations to the people of Oklahoma.”

But Wigley said the incentive on GPT — also called a severance tax — gives Oklahoma an advantage over other states. He said that will create more state revenue in the long run.

“We feel like when nobody else comes close, [increasing GPT] would be a horrible idea and it would disincentive people from starting up projects,” he said. “You might see them switch to Texas or New Mexico.”

Cantrell disagreed.

“I don’t think anybody does their economics based on a severance tax,” he said.