(Update: This story was updated at 10:20 a.m. Wednesday, May 24, to include photos of state-agency allocation documents. The photos are at the bottom of the article.)

In a turnaround of strategy, GOP leadership ran a handful of new measures Tuesday that would raise hundreds of millions of dollars in new state money without needing a 76-vote supermajority on the House floor.

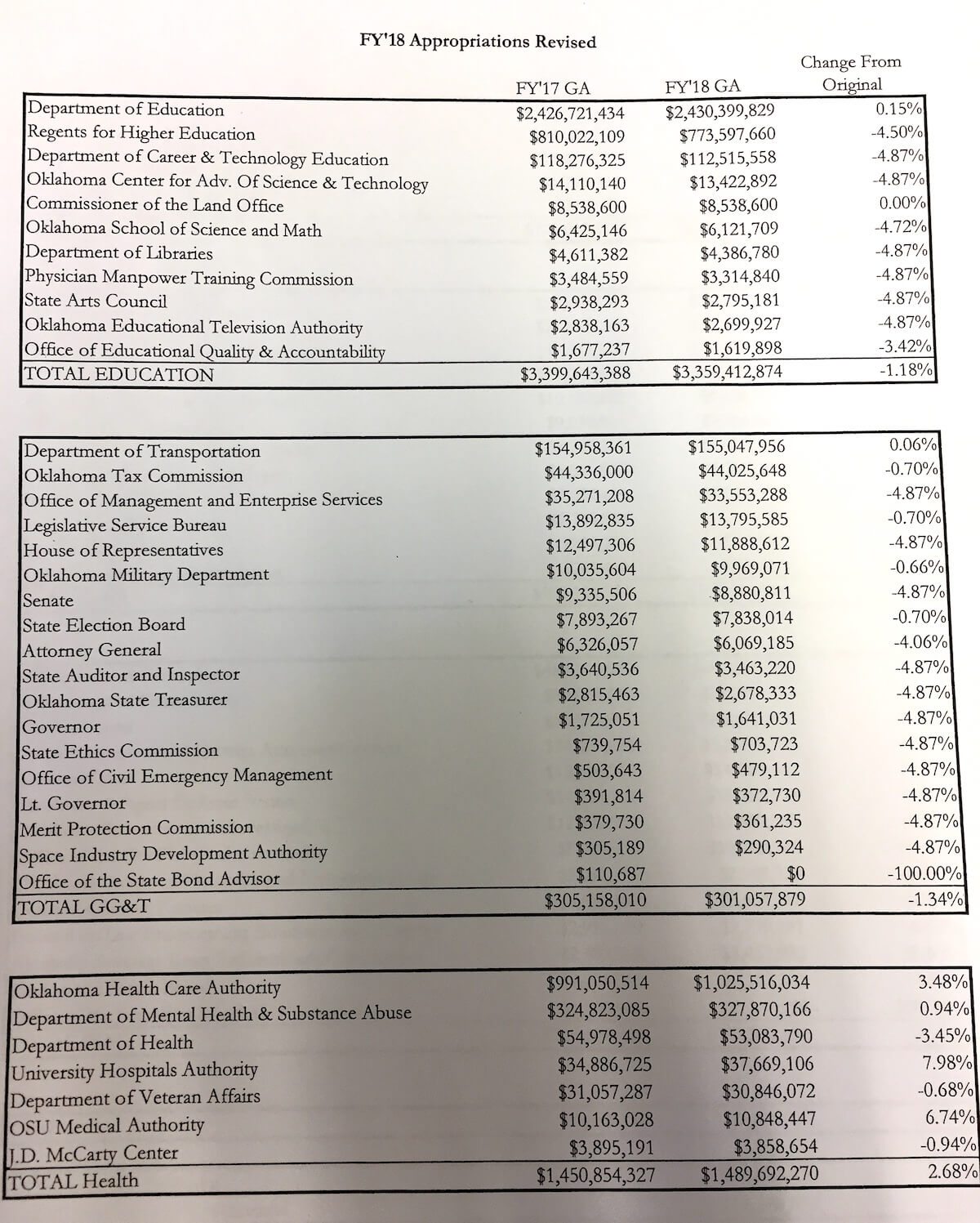

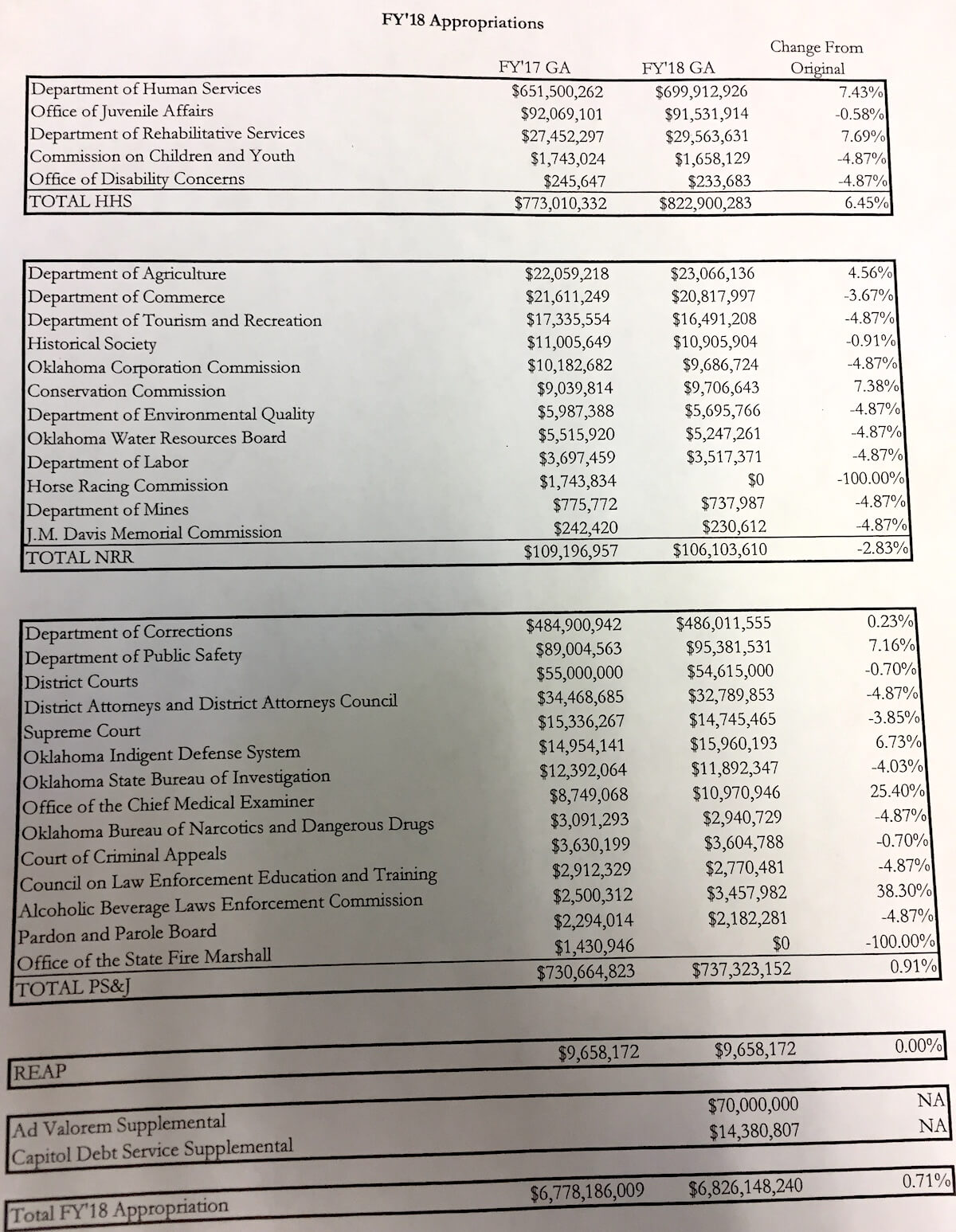

By the end of the night, lawmakers had used that money to frame two appropriations bills supposedly holding a dozen state agency budgets flat. HB 2400 includes a $1,000 teacher pay raise and cuts around 8 percent for other agencies, and SB 860 includes no teacher raise and cuts between 4 and 5 percent, according to House Appropriations and Budget Chairwoman Leslie Osborn (R-Tuttle).

Both bills were voted out of House JCAB, and Senate JCAB passed SB 860 just after 1 a.m. Wednesday. But the upper chamber’s committee adjourned without taking up HB 2400, which means it is likely stalled.

SB 860 will head to the Senate floor (later) Wednesday and then to the House on Friday, according to rules read by Osborn.

“These are not appropriate funding levels. These are horrible funding levels,” Osborn said.

‘We are doing this the wrong way’

The effort indicated a shift in GOP thinking after bipartisan negotiations broke down for nebulous reasons this week. As a result, Republicans sought to fill the state’s $878 million budget hole with measures requiring only 51 House votes.

House Minority Leader Scott Inman (D-Del City) said earlier Tuesday that Gov. Mary Fallin had floated a grand tax bargain Monday that included a cigarette tax, a fuel tax, an income tax hike on two top tiers of joint-filing married couples and a doubling of the gross production tax on new wells from 2 to 4 percent.

When asked if it was a “deal” that he “rejected,” Inman said in a press conference that he told the governor the specific numbers would need to be changed for his caucus’s support.

But Inman said he never heard back from Fallin or House Speaker Charles McCall (R-Atoka) regarding that proposal, and Republican leadership struck out in a different direction Monday and Tuesday.

“At this point, people have drawn their lines in the sand, and those lines have not been in the best interests of the state,” Osborn said during Tuesday night’s meeting.

House Majority Floor Leader Jon Echols (R-OKC) took a similar a similar stance Tuesday around noon.

“It appeared we’d reached an impasse, and we have to pass a budget,” Echols said. “At the end of the day, the Republicans need to lead.”

To that end, Republicans rolled out additional measures intended to work around a constitutional requirement prohibiting any “revenue bill” from being passed in the last five days of session.

“All of those are revenue-raising measures that are prohibited by the constitution in the last five days of session, and we are confident that all of them will be challenged in court by somebody,” Inman said Tuesday at his press conference.

Echols said the Oklahoma Supreme Court’s past decisions provide precedent for hearing and passing the measures crafted this year.

“We’re going to pass a responsible budget,” Echols told Rep. Jason Dunnington (D-OKC) during committee debate Tuesday evening. “I know it bothers you, I’m sorry it bothers you, but it still doesn’t run afoul of the constitution.”

But with several groups around the Capitol already planning legal challenges of the GOP’s 23rd-hour revenue bills, Dunnington said lawmakers were letting their constituents down.

“We’ve had four months to do this the right way, and we’re doing this the wrong way,” Dunnington said. “Each one of us sitting at the table knows we are doing this the wrong way.”

Rep. Emily Virgin (D-Norman) called the situation “asinine.”

Bills unveiled Tuesday and the budget

On those bills released Tuesday, GOP leadership argued they require only 51 House votes and avoid the requirement of 76 votes by not technically being tax increases.

The measures either implement fees or repeal tax exemptions, but Echols said they were not his first preference.

“I would prefer a grand bargain. I would much prefer that. I would much prefer the negotiations had been more fruitful, and I would have much preferred a bipartisan manner,” Echols said Tuesday about noon. “But to have a grand bargain, all sides have to give. Clearly, whether you want to blame Rep. Inman or whether you want to blame Republican leadership, all sides didn’t give enough to get there.”

The subsequent bills revealed Tuesday could raise more than $400 million, according to GOP estimates, and the budget bill passed through committees late that night.

SB 860 breaks down the appropriations and held 12 agencies at flat budgeting, according to Osborn. While the bill text was not initially available to the press or public, she named the following agencies as receiving a flat appropriation:

Oklahoma State Department of Education

Oklahoma Tax Commission

Oklahoma State Election Board

Oklahoma Health Care Authority

Oklahoma Department of Mental Health & Substance Abuse Services

Oklahoma Department of Veterans Affairs

Oklahoma Department of Human Services.

Oklahoma Office of Juvenile Affairs

Oklahoma Department of Corrections

Oklahoma Medical Examiner’s Office

Oklahoma Court of Criminal Appeals

Oklahoma District Courts

Oklahoma Indigent Defense System

SB 860 (embedded below) passed House JCAB 20-8 without debate owing to Echols pressing that motion to focus on the second general appropriations bill, HB 2400 (embedded below), that would have held the same agencies flat but with higher percentage cuts to include a $1,000 increase to the base teacher pay scale.

Since HB 2400 was not heard by the Senate, SB 860 would appear to be the budget measure moving forward.

Both chambers’ committees did pass SB 845, which creates the “Smoking Cessation and Prevention Act of 2017” that includes a $1.50-per-pack “fee” on cigarettes after first directing state agencies to innovate new programs and efforts to decrease smoking in Oklahoma. The bill appears to be an undeniable yet creative workaround for the cigarette tax previously voted on by committees and the House floor. Oklahoma Tax Commission estimates somehow jumped from $215 million on the original version to $257 million on Tuesday’s.

HB 2433 modifies the state’s sales tax exemption on motor vehicle sales to exempt all but 1.25 percent of the tax. The tax applies to new and used vehicle purchases.

SB 844 moves $32 million from what is colloquially called the Rainy Day Fund and dedicates it to the Oklahoma Health Care Authority, the state’s Medicaid agency.

SB 852 moves $33 million from the same fund and dedicates it for the support of public schools.

One other bill to change a tax exemption had passed the House floor on Tuesday

HB 2429 raises from 1 percent to 4 percent the incentive rate for gross production taxes on oil and gas wells that were drilled between July 1, 2011, to July 1, 2015. Rep. Kevin Wallace (R-Wellston) said more than 5,000 wells fall into that range.

SB 860 language

Loading...

Loading...

HB 2400 language

Loading...

Loading...