The looming question of whether the state has authority to tax the income of citizens of the Five Tribes who live and work within their reservation boundaries could end up before the U.S. Supreme Court, Oklahoma Supreme Court justices and parties’ attorneys hinted during oral arguments today in Stroble v. Oklahoma Tax Commission.

“Once you have a reservation holding, various principles flow from that, and what we are asking you to do is simply to recognize and vindicate the long-established principle that where you do have a reservation there is immunity from state income taxes,” said Riyaz Kanji, an attorney for the Muscogee Nation.

During rebuttal arguments, Vice Chief Justice Dustin Rowe posed a question to Kanji that points to the uncertainty defining eastern Oklahoma jurisdiction for the past three years: Are the Five Tribes’ territories affirmed as reservations under 18 U.S.C. 1151(a) only for the purposes of criminal jurisdiction, or are they reservations for civil jurisdiction purposes as well?

“Would you also agree, as I mentioned to your opposing counsel, that, although we are the Supreme Court of Oklahoma, essentially we’re marking time?” Rowe asked. “We don’t get the final say. The United States Supreme Court will ultimately say whether (Section) 1151 (of federal code) is extended or if there is a Sherrill test or Congress will determine the reservation status, but that’s where this is headed, is it not?”

Kanji responded by encouraging justices to rule in favor of Alicia Stroble, a Muscogee Nation citizen who has applied for exemption from Oklahoma income tax under state code and federal precedent.

“Very candidly, if this court were to uphold the rule of law to vindicate the black-letter principle, I’m not sure the (U.S.) Supreme Court would take that case. It would not create a conflict with any established precedent,” Kanji replied.

The case, Stroble v. Oklahoma Tax Commission, is an appeal of a decision by the OTC, which denied Stroble’s claim that her 2017, 2018 and 2019 income taxes paid to the state should be refunded because the state lacked jurisdiction to collect the taxes.

In July 2020, the landmark U.S. Supreme Court decision in McGirt v. Oklahoma affirmed the Muscogee Nation Reservation’s existence, and subsequent state-court decisions did the same for the Cherokee, Chickasaw, Choctaw, Seminole, Quapaw, Peoria, Ottawa and Miami nations’ reservations.

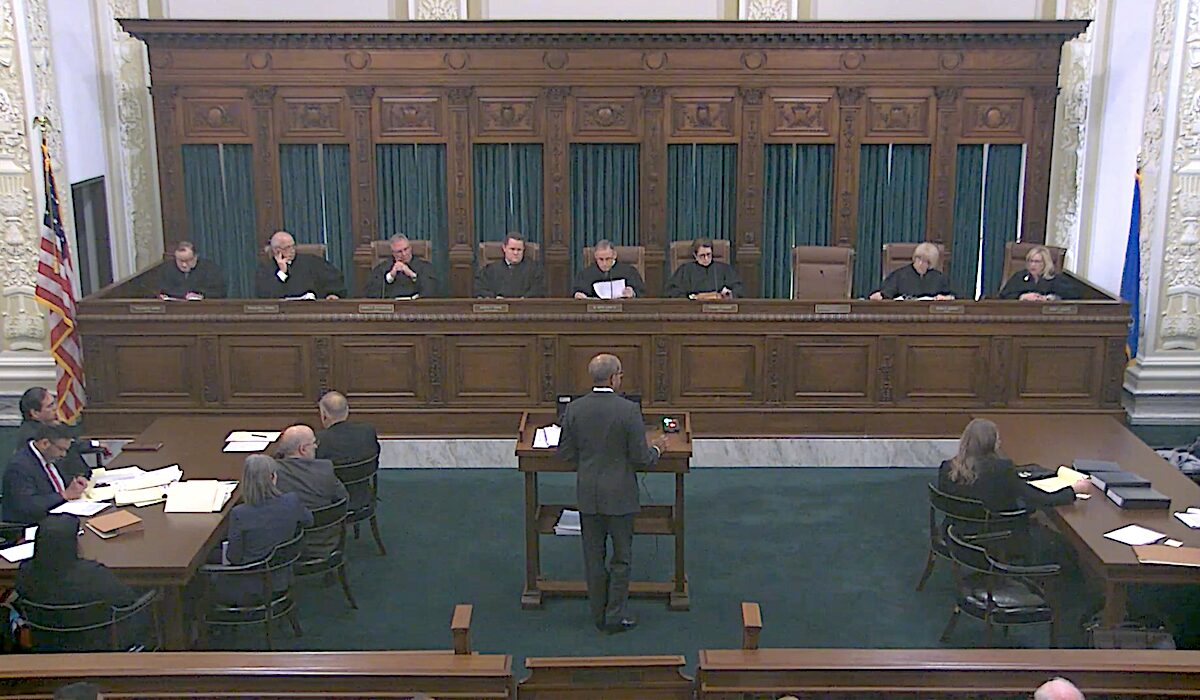

Click to watch:

Stroble v. OTC

oral arguments

Stroble’s argument is based on the 1973 U.S. Supreme Court case McClanahan v. Arizona Tax Commission and its progeny, which held the state of Arizona could not impose an income tax on Navajo citizens residing in the Navajo reservation that derived their income from tribal sources. That unanimous decision, written by Justice Thurgood Marshall, found that “appellant’s rights as a reservation Indian were violated when the state collected a tax from her which it had no jurisdiction to impose.”

After a short introduction from Stroble’s attorney, Michael D. Parks, most of Wednesday’s presentation for Stroble was led by Kanji, a Michigan-based attorney hired by the Muscogee Nation who also represented the tribe during the McGirt litigation.

The Oklahoma Tax Commission, a state agency whose tax decisions have been appealed to the U.S. Supreme Court before — notably in the 1994 case Oklahoma Tax Commission v. Sac and Fox Nation — maintains that it has the right to tax Stroble’s income under Oklahoma law and the U.S. Supreme Court’s decisions in Oklahoma v. Castro-Huerta (2022) and City of Sherrill v. Oneida Indian Nation of New York (2005).

The OTC’s entire oral argument was presented by Kannon Kumar Shanmugam, a partner at a Washington-based law firm. Oklahoma Attorney General Gentner Drummond declined to submit a brief to the court after the court issued an order allowing his office to intervene.

“I have concluded that all issues have been thoroughly briefed by all parties, and there is little value that another brief would contribute,” Drummond wrote.

Stroble’s argument centers on implications of McGirt

Stroble was supported in her briefs by amicus filings from the Five Tribes, including one filed by now-Judge Sara Hill on behalf of the Cherokee Nation. Most of the briefs center on the McGirt decision and that the Muscogee Nation Reservation’s affirmation means Stroble lived in “Indian Country” in 2017-2019, the three-year appealable period predating the McGirt decision.

The rest of Stroble’s briefs and the amici briefs argue the inapplicability of the Castro-Huerta and the City of Sherrill decisions, respectively an expansion of state jurisdiction to prosecute non-tribal citizens who commit crimes against tribal citizens and the denial of a tribe’s claim that its historic land in New York was still a reservation.

During oral argument, Kanji pointed to the City of Sherrill decision’s limitations.

“Sherrill is not and has not been treated as a magic wand that the commission or a state can waive around whenever they don’t like the result of a case,” Kanji said. “Sherrill applies in very specific circumstances that are categorically different from the circumstances present here.”

While Stroble’s appeal specifically deals with income tax jurisdiction, justices asked the attorneys Wednesday whether their ruling could affect other elements of civil jurisdiction in eastern Oklahoma, such as sales tax, property tax and zoning ordinances.

Kanji said tribal citizens living and purchasing goods within their reservation boundaries would be exempt from sales tax, but he said federal law stipulates they would be subject to property taxes.

“This extension seems to me to go a very long way,” Justice Yvonne Kauger said. “What if I’m living in Okmulgee on fee simple land within Indian Country and the City of Okmulgee has an ordinance that you can’t have more than four dogs and you have to have a fence around your swimming pool? Who has jurisdiction over that?”

Kanji responded by attempting to keep the focus on taxation questions.

“With respect to issues including zoning, licensing, other claims that have been raised, the rules are different than in the income tax context,” he said.

But Kauger said the broader implications on civil law in Oklahoma could be “like a quilt patch.”

“If I do not have tribal citizenship and I live next door to you, we’re going to have two different rules?” she asked.

Oklahoma Tax Commission raises multiple arguments

In briefs and during Wednesday’s hearing, the Oklahoma Tax Commission focused on three main arguments: Stroble does not live in “Indian County” as defined by state law, federal law does not preempt the state’s taxation jurisdiction, and the City of Sherrill decision bars Stroble’s claim of exemption from state income tax.

The OTC argued that state law defines “Indian Country” differently than federal law and that state law excludes Stroble’s claim from being exempt from income taxation. Rowe indicated he thought the state law argument was the OTC’s “strongest argument” and that it was the least likely to be successfully appealed to the U.S. Supreme Court.

“If we rule as a matter of state law that the Tax Commission has interpreted the state code correctly, isn’t that your strongest position?” Rowe asked Shanmugam.

Shanmugam also argued that the Castro-Huerta decision created a presumption of state authority in Indian Country and that the “Bracker balancing test” — a prescribed consideration for courts to weigh state, tribal and federal interest against one another — did not preempt that state authority.

During his oral arguments, Shanmugam said there is no basis in federal law for preemption and that a state tax would not infringe on tribal sovereignty since tribal nations could still levy their own income taxes if they so choose.

Does City of Sherrill v. Oneida Nation apply?

The most complex argument put forth by OTC was their position based on City of Sherrill v. Oneida Nation.

In Sherrill, the U.S. Supreme Court rejected the Oneida Nation’s argument that by repurchasing land within its former reservation, it had automatically restored the reservation status of the land. In a controversial decision authored by Justice Ruth Bader Ginsburg, the court held the Oneida Nation was barred by equitable defenses from raising its claim in court 200 years after its reservation was sold.

In the Stroble case, the Oklahoma Tax Commission argues that the Sherrill ruling provided a three-factor test for determining whether a tribe’s reservation sovereignty remains: the length of time the tribe’s authority was absent from the land, the expectations of people who live in the affected area, and the disruptiveness of a change.

Oklahoma Supreme Court justices seemed skeptical of the state’s Sherrill argument. In addition to Rowe’s question about the U.S. Supreme Court getting the final say on any decision based on Sherrill, Justice Dana Kuehn also asked about the uniqueness of the facts in that case.

“With Sherrill and the equitable decision, obviously the Sherrill case was a very interesting position,” Kuehn said. “A tribe that had their lands taken, then they were back, then they were sold, then they were buying them back. I mean that is an interesting one-time case, would you agree?”

Shanmugam replied that “the facts of the case were unusual” before continuing.

“I don’t think that the equitable principles the court announced in Sherill were limited to that context,” he said.

‘Broader consequences beyond the tax context’

Eight justices attended the hearing on Wednesday, with Justice James Edmondson absent.

In a press conference held after the hearing, Principal Chief David Hill of the Muscogee Nation read a brief statement before Kanji and Muscogee Nation Attorney General Geri Wisner answered questions.

“Laws related to taxation of income earned by tribal citizens who both reside and earn that income on a reservation have been settled for decades, but the State of Oklahoma has chosen to ignore those laws,” Hill said. “It should concern every resident of Oklahoma that the state feels like it can pick and choose when to follow the law. Today, it’s Alicia Stroble, tomorrow it will be someone else if the state is not held accountable. The state is not above the law, and it is our hope that this case will ensure the Oklahoma Tax Commission recognizes that.”

Asked what he would tell Oklahoma Gov. Kevin Stitt about the case, Kanji was succinct.

“I would love to have a conversation with the governor, and I’d say that it is time for Oklahoma to return to cooperation between the state and the nation,” Kanji said.

One day prior, Stitt called another special session for the Oklahoma Legislature to consider reducing the state’s personal income tax rate by 0.25 percent, a topic raised briefly during Wednesday’s hearing. In October, Stitt called a separate special session for a broader array of potential tax changes, including a “trigger” to eliminate Oklahoma’s income tax entirely if the state Supreme Court ruled in favor of Stroble.

Justices were told that ruling in favor of Stroble would have an annual fiscal impact of eliminating about $72 million in state income tax revenue currently paid by tribal citizens living and working within their reservations.

Still, whatever the Oklahoma Supreme Court rules could be challenged by either party before the U.S. Supreme Court.

“As Vice Chief Justice Rowe was asking, I think that there is a very good chance that the federal law issues that are presented in this case are ultimately going to have to be resolved by the United States Supreme Court, both the question of the extent to which federal law preempts state law, and the question of the application of Sherrill,” Shanmugam said. “Both of those issues have broader consequences beyond the tax context for the other contexts that we’ve been discussing today, such as the contexts of licensing and zoning and the like.

“Those chips are going to fall where they may in Washington at some point down the road.”